2016 Identity Fraud: Fraud Hits an Inflection Point

- Date:February 02, 2016

- Author(s):

- Test

- Kyle Marchini

- Sarah Miller

- Report Details: 51 pages, 37 graphics

- Research Topic(s):

- Fraud Management

- Fraud & Security

- PAID CONTENT

Overview

On its face, fraud in 2015 appears not to have changed substantially. The total number of victims remained steady at 13.1 million, and the total fraud amount fell slightly to $15 billion. However, that stability masks major changes in fraud in the U.S. As EMV becomes more ubiquitous, fraud at physical storefronts becomes very different – driving a movement from counterfeit card fraud to new account fraud. With growing online retail volume comes greater opportunity for criminals – pushing fraud to card-not-present channels. The stakes are high for both financial institutions and merchants, since poorly handled fraud undermines financial relationships and can even result in victims’ being less willing to take necessary steps to protect themselves.

The 2016 Identity Fraud Study found four significant trends:

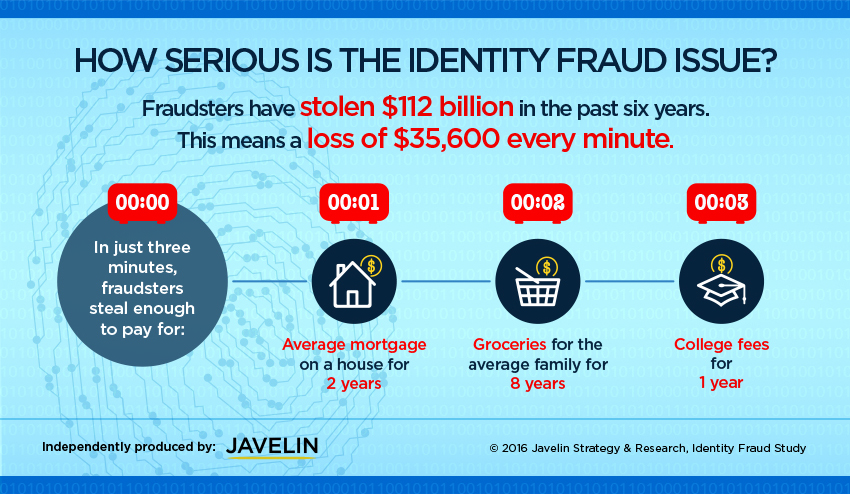

- More identity fraud victims, less stolen – The number of identity fraud victims was at its second highest level in six years, but the amount stolen was at its lowest point in the past six years. Identity fraud is a serious issue as fraudsters have stolen $112 billion in the past six years. That equals $35,600 stolen per minute, or enough to pay for four years of college in just four minutes.

- EMV drives a doubling of new account fraud – In 2015 the U.S. switched to EMV, which is designed to reduce in-person fraud and the profitability of counterfeit card operations. Fraudsters have reacted by moving away from existing card fraud to focus on new account fraud. This drove a 113 percent increase in incidence of new account fraud, which now accounts for 20 percent of all fraud losses.

- Consumer choices negatively impacting fraud detection – The study found those consumers that do not trust their financial institutions and do not take advantage of the services offered by them are setting the stage for more damage if they become fraud victims. The study found consumers that do not trust their financial institutions are less likely to use transaction monitoring, email alerts, credit freezes and black market monitoring. This results in their information being used for 75 percent longer by fraudsters and incurring a 185 percent greater mean consumer expense than those victims that have high trust in their financial institutions.

- U.S. consumer data being used for fraud internationally – Identity fraud is a global issue. The study found that 18 percent of the identity fraud using U.S. credit cards, or $2.4 billion, was conducted outside the U.S. There was an average of $1,585 per incident, although for most consumers there was no out of pocket cost as the major issuers offer $0 liability. Issuers are doing a good job of quickly detecting this type of fraud. They are proactively detecting 69 percent of these cases.

For more, read Press Release

Methodology

The Javelin Identity Fraud report provides businesses, financial institutions, government agencies, and other organizations an in-depth and comprehensive examination of identity fraud and the success rates of methods used for prevention, detection, and resolution.

2015 Survey Data Collection

Javelin’s ID Fraud survey was historically fielded as a landline survey using computer-assisted telephone interviewing (CATI). At the time of the survey’s inception in 2003, landlines provided a relatively comprehensive coverage of the U.S. population. However, with the advent of time and technology, landline coverage has been shrinking — thus the ID Fraud survey has had increasingly less penetration into the younger, more mobile population. Cognizant of this shift, in 2011 Javelin fielded the ID Fraud survey through the KnowledgePanel®. Javelin continued to use KnowledgePanel for our 2013 ID fraud survey in order to obtain the most representative sample of U.S. adults.

KnowledgePanel is the only probability-based online panel in the U.S. Through mail, the panel recruits households with no access to Internet (at the time of recruitment) as well as cell phone-only households. The panel offers a mix of RDD-based recruitment (1999–present) and address-based sampling (introduced in 2008 and rolled out in full in 2009).

The 2015 ID Fraud survey was conducted among 5,111 U.S. adults over age 18 on KnowledgePanel; this sample is representative of the U.S. census demographics distribution, recruited from the Knowledge Networks panel. Data collection took place from October 15 to November 2, 2015. Final data was weighted by Knowledge Networks, while Javelin was responsible for data cleaning, processing, and reporting. Data is weighted using 18+ U.S. Population Benchmarks on age, gender, race/ethnicity, education, census region, and metropolitan status from the most current CPS targets.

Contributing Organizations

The study was made possible in part by LifeLock, Inc and MasterCard. To preserve the project’s independence and objectivity, the sponsors of this project were not involved in the tabulation, analysis, or reporting of final results.

Book a Meeting with the Author

Related content

Crypto Investment Scams: How Banks Can Disrupt These Criminal Operations

Cryptocurrency investment scams have evolved into organized, global operations that are stealing billions of dollars from consumers. Recent enforcement actions and platform disrupt...

Foolproof Payments: How AI is Revolutionizing Payment Fraud

Payment fraud is becoming harder to detect as transactions move faster and fraud tactics evolve. Fraud teams are being pushed to make quick decisions with limited context, leading ...

2025 Know Your Customer and Know Your Business Solution Scorecard

KYC and KYB tools play critical roles in preventing fraud and supporting compliance efforts. This report compares 17 leading KYC and KYB vendors in the U.S. market and examines how...

Make informed decisions in a digital financial world