2019 Cybersecurity Trends

- Date:January 15, 2019

- Author(s):

- Sean Sposito

- Test

- Report Details: 8 pages, 3 graphics

- Research Topic(s):

- Cybersecurity

- Fraud & Security

- PAID CONTENT

Overview

Financial institutions are driving toward a future where there’s little difference between online and offline banking. In that world where the edge of a firm’s business is defined more by an omnichannel experience than just its brick-and-mortar branches, information security is a service. It’s not just an internal function — protecting against malicious infections and insider threats — but a driver of new business.

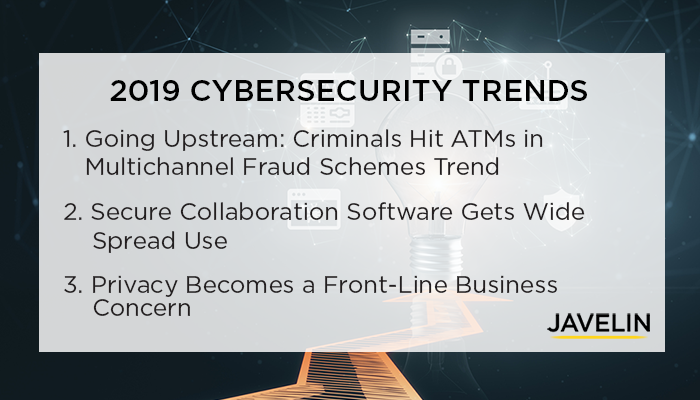

It’s all a part of the covenant our industry keeps with retail banking customers. In the New Year, Javelin expects:

- ATM owners will continue to see logical security as a significant — and increasing — threat to its cash machines as retail customers rely on them as virtual tellers

- Corporate security teams to increasingly use secure collaboration tools as an outgrowth of the identity deception crimes (read phishing) FIs face

- Retail banks — already viewing consumer trust as a function of security — will increasingly discuss privacy as more than just a regulatory hurdle

Book a Meeting with the Author

Related content

Data Transparency in the Age of Cyber and Privacy Risk

As open banking and new privacy regulations accelerate, financial institutions face rising pressure to enhance privacy and cybersecurity transparency to strengthen consumer trust. ...

Quishing and the Resurgence of BYOD Cyber-Attack Exposure

North Korean attackers’ latest efforts to target foreign policy experts through a technique known as quishing expose long-standing bring-your-own-device vulnerabilities that U.S. o...

SMS Blasters: An Expanding Frontier in Smishing Attacks

Cybercriminals use SMS/text blasters in smishing attacks, sending a wide range of fraudulent messages. By mimicking legitimate cell towers, SMS/text blasters bypass carrier-level p...

Make informed decisions in a digital financial world