2018 Child Identity Fraud Study

- Date:April 24, 2018

- Author(s):

- Kyle Marchini

- Report Details: 26 pages, 17 graphics

- Research Topic(s):

- Fraud Management

- Fraud & Security

- PAID CONTENT

Overview

This original report, sponsored by Identity Guard, examines the risks that child identity fraud poses to minors and their guardians along with the most effective steps that guardians can take to mitigate those risks.

This research report was independently produced by Javelin Strategy & Research. Javelin Strategy & Research maintains complete independence in its data collection, findings, and analysis.

A thank you to our sponsor, Identity Guard, for making this report available to Javelin Advisory Services clients for their internal use only.

Javelin retains the ownership of the survey, raw data, methodology and all other project deliverables. While Javelin may selectively grant other non-competing organizations selective rights to use the project’s findings in other public venues, we retain ultimate discretion over such decisions.

Javelin Advisory Services clients and other non-sponsors do not have immediate rights to cite any findings in their marketing campaigns, press releases, webinars, or any other external communications. Please inquire with your Javelin Relationship Manager about licensing rights to cite or otherwise reproduce data findings or graphs.

TABLE OF CONTENT

- Executive Summary

- Key Findings

- Recommendations

- General Trends

- Prevention

- Safety Strategies Matter: Guardians’ Role in Fraud Prevention

- Child Fraud: A Familiar Fraud Story

- Bullying: An Indicator of Fraud Vulnerability

- Detection

- Resolution

- Appendix

- Methodology

TABLE OF FIGURES

Figure 1: Overall Child Identity Fraud Figures

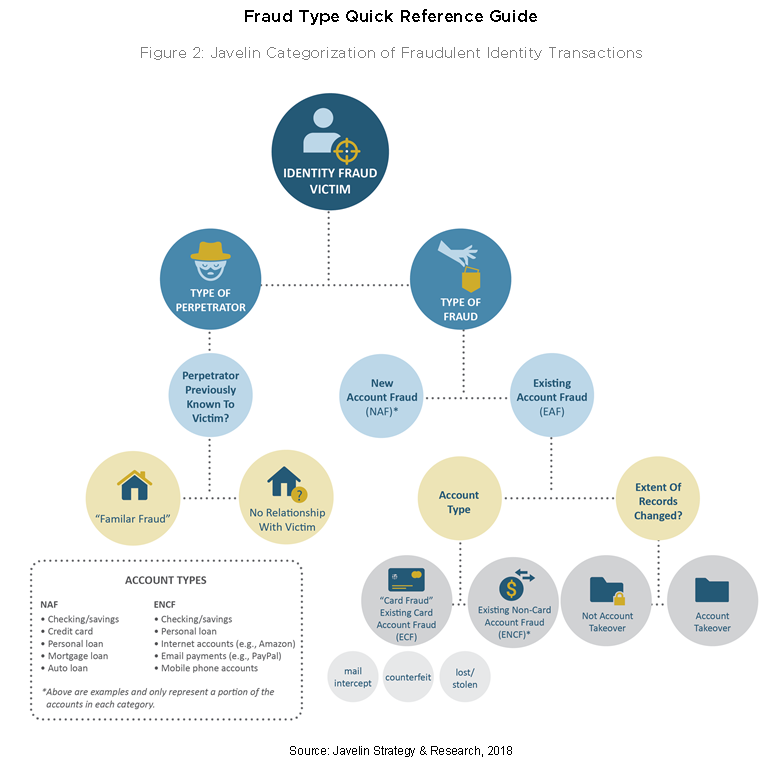

Figure 2: Javelin Categorization of Fraudulent Identity Transactions

Figure 3: Fraud Incidence and Losses Among Minors

Figure 4: Age at Which Minors Became Fraud Victims

Figure 5: Postbreach Fraud Incidence, Past 12 Months

Figure 6: Age at Which Guardians Believe Activities Are Appropriate

Figure 7: Fraud Incidence and Losses by Guardians' Level of Caution

Figure 8: Percentage of Victims Who Personally Know the Perpetrator

Figure 9: Perpetrators of Familiar Fraud Against Minors

Figure 10: Concern About Online Threats Facing Children

Figure 11: Fraud Incidence Among Victims Bullied Online or in Person

Figure 12: Time from Misuse to Detection of Fraud

Figure 13: How Child Fraud Victims’ Guardians were First Notified

Figure 14: Mean Fraud Amount by Familiarity With Perpetrator and Type of Bullying

Figure 15: Percentage of Child Fraud Cases in Which Institutions Are Contacted

Figure 16: Satisfaction With Service Providers Contacted for Fraud Resolution

Figure 17: Fraud Incidence, Past 6 Year

OVERVIEW

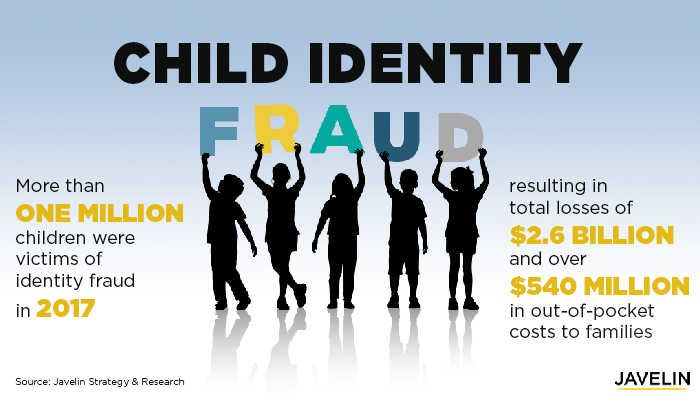

Child identity fraud is a very real problem, but it is often overlooked with so much of the public’s focus on recent breaches involving the personally identifiable information of adults. To characterize it as an “adult problem” is to overlook an extremely vulnerable population with minimal ability to protect itself without assistance. In 2017, over a million children were affected by identity fraud, resulting in losses totaling $2.6 billion and families paying over $540 million out of pocket. In this report, Javelin explores the phenomenon of child identity fraud, including the major drivers this type of fraud, along with the prevention, detection, and resolution steps that parents and guardians can take to keep children safe.

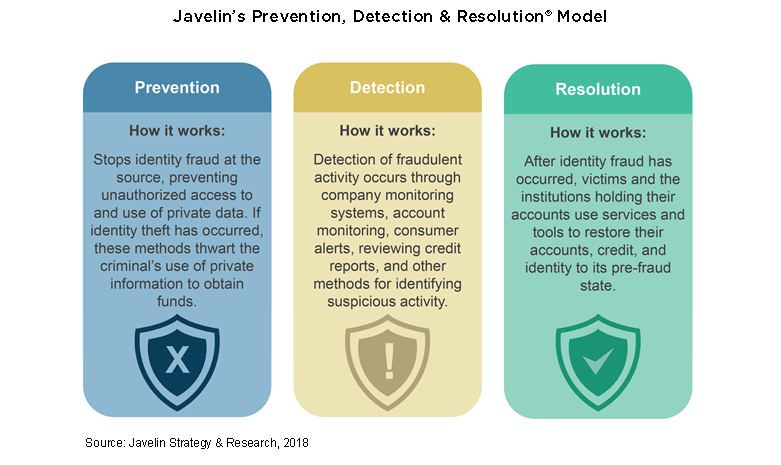

Javelin’s Prevention, Detection & Resolution® Model addresses how consumers, businesses, financial institutions, and others can prevent identity fraud from occurring, detect when suspicious activity occurs, and resolve identity fraud smoothly and quickly. Each of these stages is crucial in minimizing the impact of identity fraud on child victims and the institutions where accounts are established or compromised.

Recommendations

Start training children to protect their identity in the digital world when they are young. Early training for children on properly managing their online activity will instill habits that will prove invaluable in their adulthood, reducing their risk of victimization early and later in life.

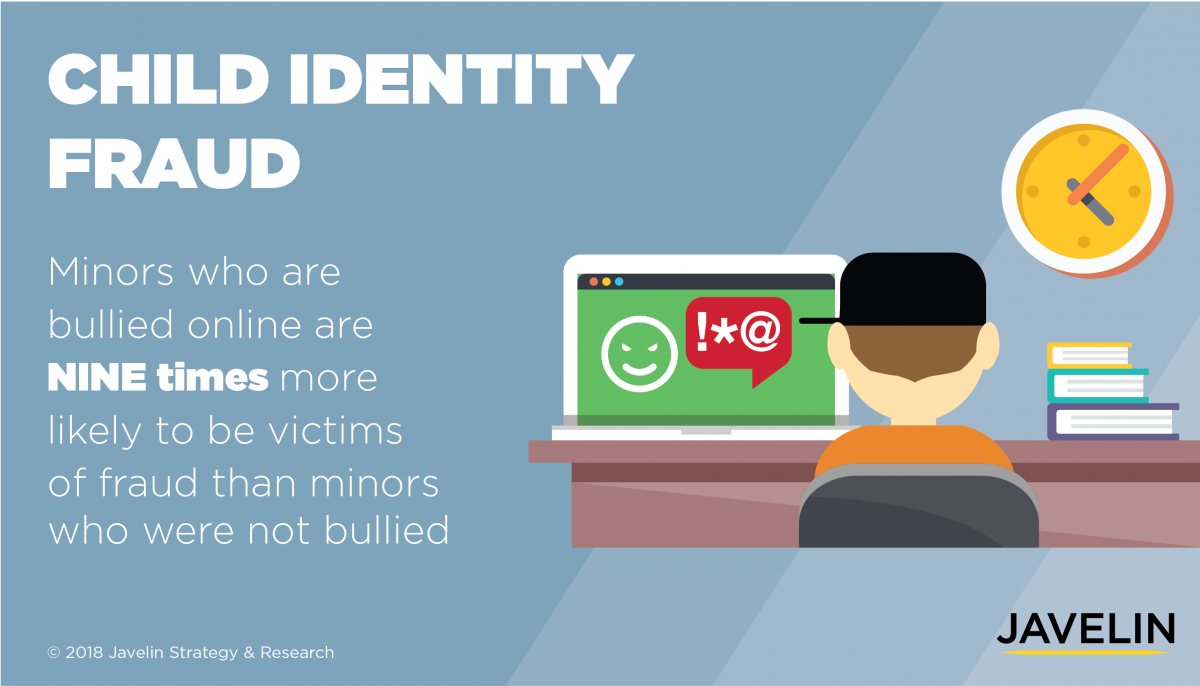

Pay special attention to children who may be bullied. In many cases, fraud and bullying are not perpetrated by the same individual, but arise from the same underlying vulnerabilities with oversharing personal information in an anonymous environment. Children who are unprepared to protect themselves from online risks are likely to encounter individuals who wish to target them emotionally or financially. Bullied children may be more vulnerable to fraud as they are taken advantage of when they seek friendship online.

Check and freeze a child's credit. New-account fraud is the most pervasive identity fraud against children, and checking their credit history is a major way to detect this type of crime. Establishing a credit freeze remains one of the most effective tools for preventing new accounts being opened in either a child or adult’s name. While there is no federal standard, many states permit parents or guardians to establish and freeze a minor’s credit.

Actively monitor existing accounts. Combating child identity fraud requires guardians to proactively manage their child’s finances — regularly monitoring activity, even when they expect that nothing has occurred; reviewing statements online; and leveraging account alerts, especially those that can be delivered to mobile devices.

Keep physical documents secure. With familiar fraud especially prevalent among child identity fraud victims, protecting the personally identifiable information (PII) of children should be a priority for parents and guardians. This means keeping sensitive documents such as Social Security cards and birth certificates behind lock and key, and out of reach of household visitors or residents.

Take breach notifications and other correspondence seriously. Notification that a child’s PII has been breached should galvanize parents and guardians to start monitoring the child’s account for unauthorized activity. Account statements and collection notices addressed to children are a clear sign of trouble and should be followed up on immediately.

Reach out for help. Overwhelmed parents and guardians of child identity fraud victims have a variety of resources available to help them restore their child’s identity. Those who require a significant degree of assistance with the resolution process can turn to identity protection providers, while directly contacting banks and credit bureaus is among the quickest routes to closing unauthorized accounts and clearing them from the victim’s credit history.

Methodology

Consumer data in this report is based on information collected from an online survey of 5000 individuals, fielded in August-September 2017, who either currently live in a household with a dependent minor or who have lived in a household with a dependent minor in the past six years. The margin of error for questions answered by all respondents is +/- 1.39 percentage points. The margin of error is higher for questions answered by smaller segments of respondents.

Book a Meeting with the Author

Related content

Crypto Investment Scams: How Banks Can Disrupt These Criminal Operations

Cryptocurrency investment scams have evolved into organized, global operations that are stealing billions of dollars from consumers. Recent enforcement actions and platform disrupt...

Foolproof Payments: How AI is Revolutionizing Payment Fraud

Payment fraud is becoming harder to detect as transactions move faster and fraud tactics evolve. Fraud teams are being pushed to make quick decisions with limited context, leading ...

2025 Know Your Customer and Know Your Business Solution Scorecard

KYC and KYB tools play critical roles in preventing fraud and supporting compliance efforts. This report compares 17 leading KYC and KYB vendors in the U.S. market and examines how...

Make informed decisions in a digital financial world