Overview

Multi-Channel Deposit Account Fraud

And Vendor Solutions

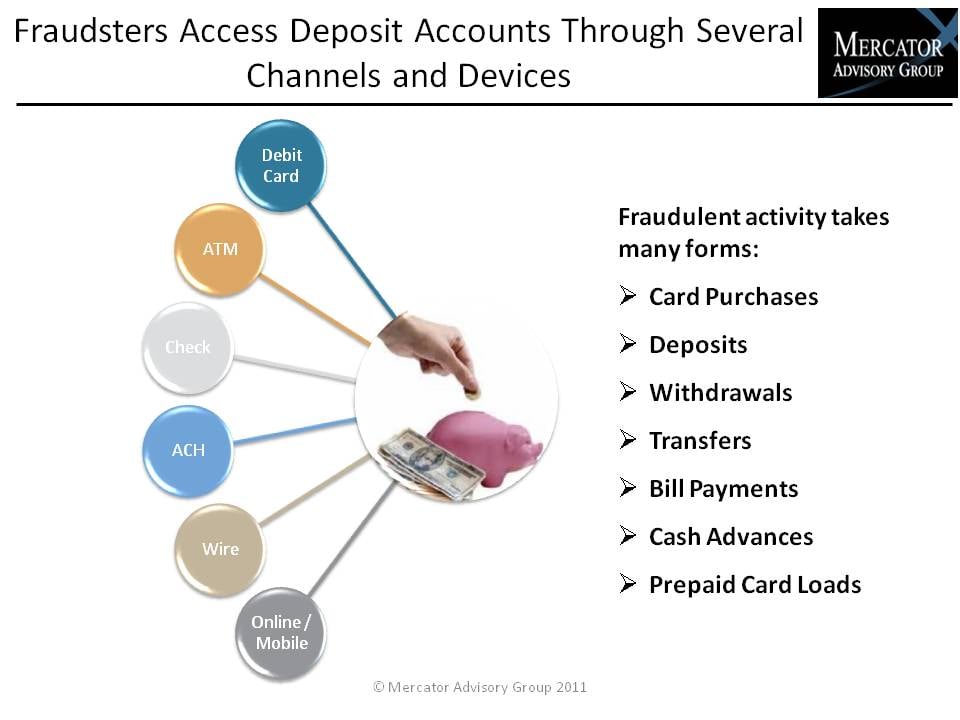

Boston, MA -- Debit cards represent only one access device through which fraudsters might attack a depository institution's account assets. Though cards supporting "signature" debit (and, to a smaller degree, PIN debit) have enabled fraudsters to access deposit accounts through fraudulent point-of-sale or card-not-present purchases, the variety of schemes that target demand deposit accounts (DDAs) often utilize multiple channels and access devices to target the cash itself in fraudulent withdrawals and transfers.

Check fraud, ACH fraud, wire transfer fraud, ATM fraud, and online banking and mobile banking fraud (in addition to debit card fraud) collectively comprise what we've come to know as deposit account fraud. Since fraud schemes that target the DDA through multiple channels are proliferating, the business case for implementing a multi-channel fraud solution has never been clearer.

Mercator's new report, Multi-Channel Deposit Account Fraud and Vendor Solutions, discusses and tries to answer these essential questions: How are these schemes being executed today by fraudsters hoping to exploit financial institutions' vulnerabilities? How are the solutions that vendors have brought to market evolving to counter these threats?

This report reviews extant research and data to illuminate today's DDA fraud landscape, provides case examples of recent fraud schemes that target deposit accounts, and profiles selected vendor solutions that help banks and payment processors manage fraud risk associated with at least one channel or device that accesses DDAs.

"A variety of point solutions exist in the market to address the risks associated with DDA fraud of different types in a specialized fashion, often looking at only one aspect of the usage of the instrument or channel without providing the user with a comprehensive understanding of the account-level behavior that underlies the broader customer relationship," David Fish, Senior Analyst at Mercator Advisory Group and author of the report comments. "Some of these solutions have evolved more recently to do exactly that, or to at least aspire to multi-channel and even "enterprise-wide" fraud management. The path to a comprehensive DDA fraud solution has been paved by specialists in various channels, however, with best-of-breed solutions in debit card fraud, for instance, requiring significant modification when applied to a different type of payment instrument or access channel."

Highlights of this report include:

Cash is a high priority for financial criminals committing payments fraud, and the variety of access devices and channels associated with demand deposit accounts makes them an increasingly attractive target.

Debit card data compromise is a chief concern to DDA risk managers due to the fact that counterfeit cards can be used both for fraudulent purchases at the point-of-sale and at ATMs for fraudulent withdrawals if the PIN has also been compromised.

Solutions vendors have typically specialized in one kind of fraud prevention over another, but the varieties of access to DDAs necessitate a broad view on the part of risk managers.

Vendors offering more comprehensive solutions tend to have aggregated point solutions that were developed by their acquisition targets ??? consolidation and rationalization of these has finally produced compelling results.

Strategic concerns for DDA risk include the outcome of the Durbin debate, the rising focus of fraudsters on commercial accounts, the ways in which vendors deliver and support their fraud risk management solutions, and the coming revisions to the Federal Financial Institution Examination Council's (FFIEC) guidance for online authentication.

One of 12 exhibits in this report:

This report is 30 pages long and has 12 exhibits.

Companies mentioned in this report include: ACI Worldwide, Aldi, American Bankers Association, Comerica, CyberSource, Early Warning Services, Experi-Metal Inc., FFIEC, FICO, First Data, FIS, Fiserv, Global Payments Inc., Hancock Fabrics, LastPass, MasterCard, Michaels, NACHA, Pulse EFT, RSA, Verizon, Visa.

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: (781) 419-1700, send E-mail to [email protected].

Follow us on Twitter @ http://twitter.com/MercatorAdvisor.

About Mercator Advisory Group

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors. Mercator Advisory Group is also the publisher of the online payments and banking news and information portal PaymentsJournal.com.

Book a Meeting with the Author

Related content

State of Debit 2026

Despite headwinds that include significant financial strain on consumers despite a broadly stable economy, debit remains resilient—especially among younger consumers and lower inco...

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Make informed decisions in a digital financial world