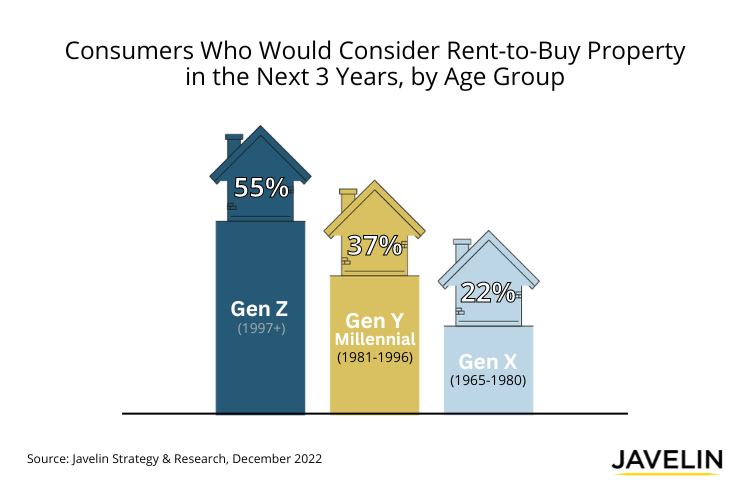

Mortgage Pandemic? Majority of Gen Z Open to Rent-to-Own, According to Javelin Strategy & Research’s Recent Report

SAN FRANCISCO, Calif., January 17, 2023 – Javelin Strategy & Research’s recent report, Mortgage Pandemic or Just the Sniffles: Fast-Track Cures and Long-Haul Boosters, reveals that 55% of Gen Zers and 37% of millennials would consider rent-to-own (aka rent-to-buy) agreements. However, due to low awareness and availability of rental properties with an option to buy later, rent-to-own agreements make up less than 2% of living situations.

Banks, lenders, investors, and incubators that concoct better rent-to-own business models and find the right partners will have a pool of eager movers.

“We heard from hundreds of consumers on triggers and questions about rent-to-buy, most desirable features, regional differences, and, notably, interest for second homes and investment properties. The level of excitement and passion was surprising,” said Babs Ryan, lead analyst for the digital lending practice at Javelin.

Deals come in a variety of flavors. What happens upon opting in or out to buy varies widely, affecting factors that include share of monthly payment put aside for down payment, purchase price of the property, and exit fees. In some cases, the lessor purchases a property selected by the renter.

Javelin’s study found that consumers are interested in—and motivated by—taking a house and a neighborhood for a ‘test drive,’ when exploring rent-to-own options.

In the U.S., celebrities Jay Z and Will Smith are among investors in pick-your-own-property-to-rent-to-own startup Landis Technologies. In the UK, Lloyds Bank is focusing on rentals. Not only does it offer “buy-to-let” mortgages, but it recently launched Citra Living, a foray into the build-to-rent market.

Javelin recommends that lenders shift from a focus on mortgages to a suite of living solutions, centered on the flow and changes in people’s lives rather than on financial products. Catering to renters and those in multigenerational households, beyond solutions for ownership, engages a greater population than homeowners, since 14.3 million renters plan to move in the next 12 months vs. 5.4 million homeowners, according to Census data.

“As evidenced by the low buy-conversion rate, U.S. rent-to-own models need rehabbing, including innovative business models, non-traditional investors and management, partnerships with real estate agent and other non-financial parties, and data-driven marketing gurus,” added Ryan. “Consumers’ primary and favored digital lenders in five to seven years are unlikely to be financial ‘institutions’ or fin-anythings.”

In addition to rent-to-own options, Mortgage Pandemic or Just the Sniffles: Fast-Track Cures and Long-Haul Boosters prescribes other digital-first options and tech-enabled remedies to capture leads and market share, boost conversion, and help ailing home lenders get better fast.

To learn more about Javelin Strategy and Research’s digital lending practice.

About Javelin Strategy & Research

Javelin Strategy & Research, part of the Escalent family, helps its clients make informed decisions in a digital financial world. It provides strategic insights to financial institutions, including banks, credit unions, brokerages and insurers, as well as payments companies, technology providers, fintechs, and government agencies. Javelin’s independent insights result from a rigorous research process that assesses consumers, businesses, providers, and the transactions ecosystem. It conducts in-depth primary research studies to pinpoint dynamic risks and opportunities in digital banking, payments, fraud & security, lending, and wealth management. For more information, visit javelinstrategy.com. Follow us on Twitter and LinkedIn.

Media Contact

Tejas Puranik

tejas.puranik@javelinstrategy.com