Overview

A new research report titled Top 10 General Purpose Reloadable Prepaid Debit Cards in the U.S. Chosen by GPR Cardholders in 2018, has been released by Mercator Advisory Group which provides a deep dive into the features, functionality, and pricing of each of the Top 10 cards. This report will be especially useful to program managers and prepaid card issuers as a means of evaluating their programs against their competitors’ programs. GPR cards will receive increased scrutiny regarding their fees and disclosures when pending prepaid card regulation by the Consumer Financial Protection Bureau takes effect April 1, 2019.

"Providers of GPR prepaid debit cards should be evaluating their programs on a regular basis to be sure the program’s offerings is competitive and attracting the type of GPR cardholder that is beneficial to their portfolio," comments C. Sue Brown, Director of Mercator Advisory Group's Prepaid Advisory Service and author of the report. “What was considered new and innovative from a feature/functionality perspective five years ago is now an expected minimum basic offering on most cards. A few new trends in features/functionality as well as pricing have emerged, so program managers need to be make sure their portfolios align with them.”

This research report is 14 pages long and has 4 exhibits and a spreadsheet.

Companies and other organizations mentioned in the report include: American Express, Bancorp, Chase, Consumer Financial Protection Bureau, Discover, eBay, Green Dot Corporation, Green Dot Bank, H&R Block, InComm, Mastercard, MetaBank, Netspend, PayPal, Univision, Walmart, Western Union, and Visa.

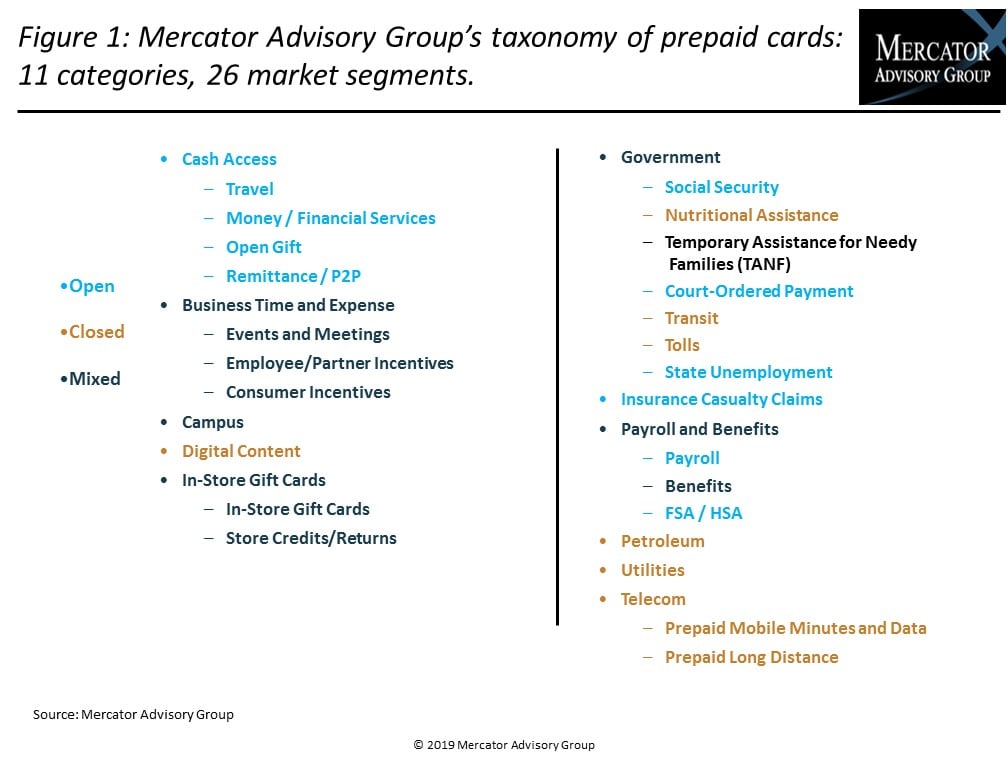

One of the exhibits included in this report:

Highlights of the report include:

- The size of the GPR prepaid debit card market in the U.S. in 2017 and a forecast for its growth

- Features, functionality, and pricing of the top 10 GPR cards (These are also compared in detail in a spreadsheet appended to the report.)

- Specific card features and functionality that are attractive to the audiences that are the likely users of certain GPR cards.

- Information necessary for a GPR prepaid debit card program manager to determine if the program’s product needs enhancements.

Learn More About This Report & Javelin

Related content

Javelin Prepaid Consumer Sentiment: 3-Year Trend Highlights

As Javelin’s research into consumer sentiment toward prepaid products completes its third year, the findings highlight relative stability in most products, and that’s significant i...

Prepaid Is Positioned to Bridge Gaps in Agentic Commerce

Announcements from Visa and Mastercard about the imminence of AI-driven purchasing agents that will act on behalf consumers have made a big splash. But underneath the dazzling view...

Payments in the Arena: Prepaid Can Move Into the Starting Lineup as Cash Gets Cut

Sports and entertainment thrive on fan loyalty but have yet to translate that dedication into long-term, connected share of wallet once fans are inside the turnstiles. Prepaid stor...

Make informed decisions in a digital financial world