On the Road to Recovery: U.S. Fleet Card Market Sizing and Forecast, 2020-2025

- Date:December 08, 2021

- Author(s):

- Ben Danner

- Research Topic(s):

- Commercial & Enterprise

- PAID CONTENT

Overview

Covid-19 has impacted the fleet card Industry – how will you respond?

Mercator Advisory Group released a report covering the fleet card market, titled On the Road to Recovery: U.S. Fleet Card Market Sizing and Forecast, 2020-2025. The research explains the current market and forecast, discusses closed- and open-loop card networks, card spend, and network volume, and explores the effects of the COVID-19 pandemic on the industry.

This research also explores current fleet tracking & telematics technology and how companies are using these advancements to reduce costs and increase safety. We then transition into the future of fleet and current state of federal and statewide climate and sustainability initiatives. Many of these innovative programs will affect the future of fleet in terms of updated fuel efficiency standards and increasing shifts towards fleet electrification.

“Sustainability initiatives may have fleets examining alternative vehicles and electrification,” comments Ben Danner, Analyst at Mercator Advisory Group, and the author of the research report. “Fleet card companies must begin to invest in the future of fleet and this means taking a serious look at advances in payments technologies and continued market awareness.”

This document contains 14 pages and 4 exhibits.

Companies mentioned in this research note include: Amazon, Comdata, EFS, Enterprise, Fleet One, FLEETCOR, Fuelman, Geotab, Hertz, Ikea, Mastercard, MSTS, Rivian, Samsara, Shell Oil Company, Tesla, Trimble, U.S. Bancorp, Verizon Connect, Visa, WEX Inc.

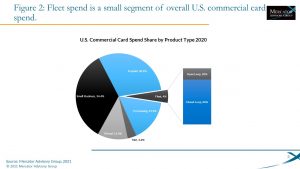

One of the exhibits included in this report:

Highlights of the research document include:

- Effects of COVID-19 on the trucking and fleet card industry

- Forecast for U.S. fleet card spend through 2025

- Purchase volumes by network share

- Overall fleet card market sizing and segmentation of total U.S. commercial card spend

- Current regulatory environment for fleet sustainability and environmental impact

- Trends in fleet electrification and fleet technology

Learn More About This Report & Javelin

Related content

The Virtual Economy: Measuring Buyer Industry Receptiveness to Using Virtual Cards

Virtual cards are a fast-growing force in business-to-business payments, but adoption remains uneven across buyer industries. This report analyzes 147 U.S. industries using a compo...

AI in Commercial Payments: Do Payables Bots Dream of Dynamic Discounts?

AI’s transformative effects are becoming evident in how businesses source and buy things. The growing use of AI—predictive, generative, and agentic—across the source-to-settle valu...

Bots in the Back Office: Agentic AI and Commercial Payments

Agentic artificial intelligence stands to reshape commercial payments, from sourcing to settlement. Accordingly, banks, enterprise resource planning providers, and fintechs would b...

Make informed decisions in a digital financial world