Overview

Boston, MA – April 23, 2014 – Growth in new credit card accounts has stalled largely because financial institutions’ appetite for risk in their portfolios has not increased significantly since the recession. This sentiment is strongest among tier 1 banks, some of which are still winding down their highest-risk portfolios, having acquired them at the peak of economic turmoil. Several vendors have developed analytics-based solutions that can help issuers profitably lend to potentially risky consumers, but for the most part, they are waiting for issuers to decide the time is right. Mercator Advisory Group’s latest Research Note, Innovative Strategies for Credit Card Account Acquisition, examines how credit issuers are effectively marketing products and originating accounts in the current economic climate.

“Large credit card issuers are almost exclusively marketing products to prime and superprime consumers, but this can only go on for so long as these are very saturated segments,” comments Michael Misasi, Senior Analyst, Credit Advisory Service at Mercator Advisory Group and the primary author of the Note. “Financial institutions have to take on more risk to grow their credit portfolios. The first banks that find a way to profitably serve riskier consumer segments will have the most opportunity for long-term growth.”

This report contains 10 pages and 5 figures.

Companies mentioned in this report include: Equifax, Experian, FICO, FIS, PNC, Zoot, US Bank, and Wells Fargo.

Members of Mercator Advisory Group’s Credit Advisory Service have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access, and other membership benefits.

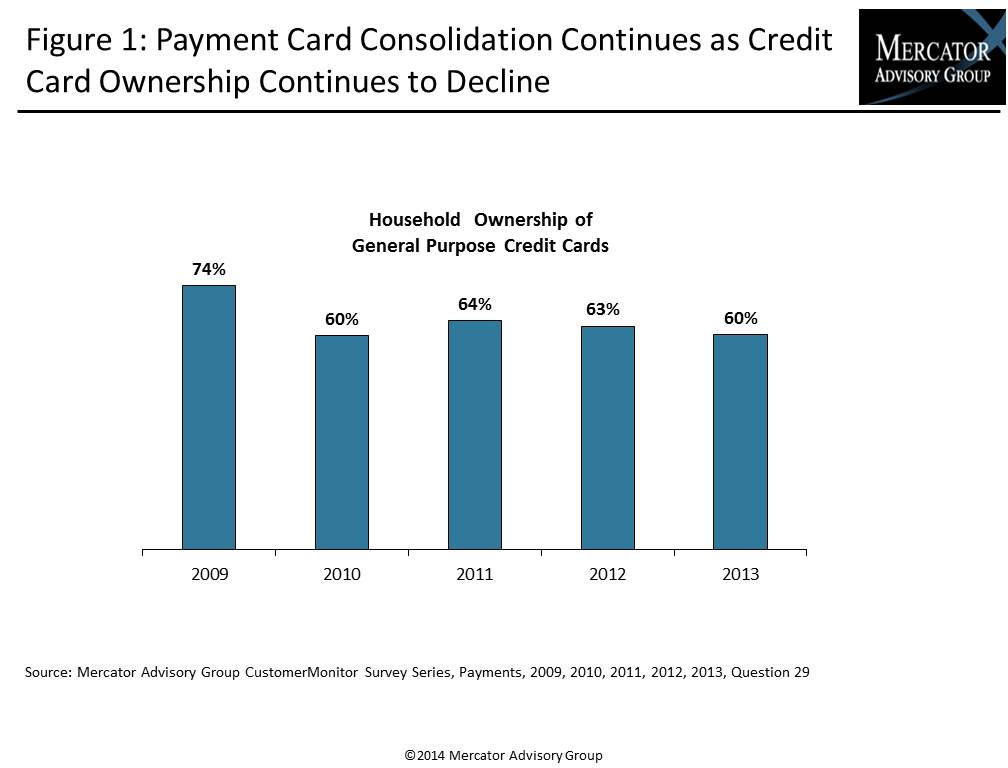

One of the exhibits included in this report:

Highlights of the report include:

- Trends in household ownership of credit cards

- Trends in approval rate for credit cards for consumers of carrying creditworthiness

- Estimated level of credit card ownership for various credit score bands

- A discussion of the role of various banking channels for credit account origination

- Profiles of noteworthy vendor solutions for card account acquisition and origination

Learn More About This Report & Javelin

Related content

From Hype to Impact: How AI is Transforming Credit

Advances in artificial intelligence have generated a high level of excitement and marketing spending as financial organizations seek to rebrand their technologies with “AI” and dev...

Amex and Chase Face Off on Premium Credit Cards, but the Backstory Is More Interesting

Moves by American Express and Chase to revamp their signature card reward products will bring the issuers into greater competition for the most affluent cardholders and carry rever...

How Will Agentic Commerce Affect Consumer Credit?

Recent product announcements from leaders in the payments industry demonstrate the excitement surrounding new AI technologies. AI isn’t just a buzzword anymore, and AI-powered pers...

Make informed decisions in a digital financial world