Overview

Digital Wallets: A Functional, Taxonomy-Driven Evaluation

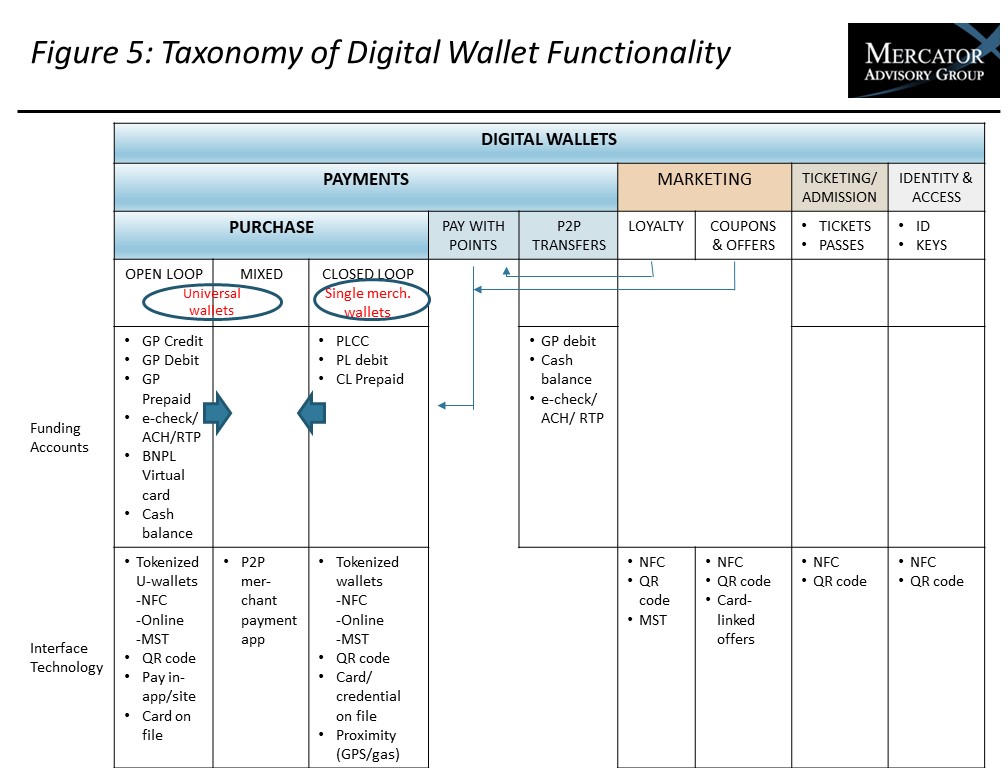

Mercator Advisory Group has been measuring consumer adoption of digital wallets for a decade. The questionnaires become more complex every year as new features and functions are added and new suppliers appear. Today there are wallets to support global card networks, national card networks, multiple merchants and single merchants. Some have added loyalty programs, others support ticketing and still others are adding support for car keys. There are also e-commerce buttons that act as wallets and merchant wallets that are adding financial services. Mercator Advisory Group’s latest research report, A Functional Taxonomy of Digital Wallets: Today’s Version, Tomorrow’s Direction, delivers a review of all the major digital wallets using a single consistent taxonomy to enable a more effective competitive evaluation of the feature/functions each wallet supports. This in turn suggests the key development and market direction being pursued by each wallet supplier.

“It is interesting to witness the expansion of wallets into new markets, from authentication to access control. Yet when one takes a step back, one doesn’t perceive these solutions staying focused on the payments market. They need to offer more benefits to win over banks, merchants and consumers,” comments Tim Sloane, Director, Emerging Technologies Advisory Service at Mercator Advisory Group and the author of the report.

This research report has 20 pages and 13 exhibits.

Companies and other organizations mentioned in this report include: Apple, Google, Samsung, PayPal, Starbucks, Cumberland Frams, Zipline, Amazon, EMVCo, McDonalds, Dunkin Donuts, Target, Walmart, Burger King, Subway, Domino's, Chipotle, CVS, Pizza Hut, Panera Bread, Cheesecake Factory, Gulf, Exxon, Venmo, BMW, FIDO, Uber, Lyft, Airbnb, OpenTable.

One of the exhibits included in this report:

Highlights of the report include:

- Digital wallets available today are very different, ranging from universal wallets (Apple Pay, Google Pay, Samsung Pay), to online pay buttons (Amazon, PayPal, and soon the Secure Remote Commerce (SRC) solutions), all the way to retailer digital wallets.

- Each digital wallet has its own set of features, sometimes implemented to help target international markets, sometimes to address new domestic markets (such as car replacing keys), and sometimes to benefit existing users, be that the consumer, the financial institution or the merchant.

- It may be that the difficulty of staying focused on specific markets, instead of chasing new markets, has prevented universal wallets from delivering a compelling solution to its three primary market participants: banks, consumers and merchants.

- Universal digital wallets have struggled to provide sufficient features to divert merchants from developing their own digital wallets Universal digital wallet providers have created significant distrust on the part of banks, by adding banking features, introducing their own card programs, as well as P2P capabilities.

- Merchants are also not enamored by the universal digital wallets, as they lack the ability to differentiate their merchant loyalty programs.

- It is likely traditional market forces will start to consolidate the functions supported in the universal wallets that are popular in the market today. Suppliers associated with what is typically called a universal wallet have all been adding new capabilities.

Learn More About This Report & Javelin

Related content

Global Biometric Pilots Help Smooth the Way for U.S. Adoption

The use of biometrics in merchant payments—such as facial scans and palm scans—has been slow to take root in the United States. But several pilot programs in other global markets, ...

Agentic Commerce: The Payments Are Here, but Are the Agents Ready?

Shifting purchase and payment behavior, as agentic commerce stands to do, is a risky business. As the role of agents in purchasing decisions and payments comes to the fore, expect ...

Payments in the Arena: Integrated Experiences Are the Winning Play

Identity will constitute the future of experiences at stadiums, ballparks, and other performance venues, giving fans—especially the most loyal ones—a seamless journey from entry to...

Make informed decisions in a digital financial world