Credit Cards in Latin America and Caribbean: Financial Inclusion with Risk and Opportunity

- Date:July 19, 2019

- Author(s):

- Brian Riley

- PAID CONTENT

Overview

Readers will understand the challenges that bank card issuers face and how card network revenue has lagged in the market. The report’s author explains how banks and vendors can navigate the changing market.

“Most adults in Latin America have a Mercado Pago or PagSeguro free digital account,” comments the author of the research report, Brian Riley, Director, Credit Advisory Service at Mercator Advisory Group. “That does not mean everyone has a bank account, but new payment options make it easy to transact outside of the banking realm. Yet strong domestic and global credit card issuers operate in the market.” He continues: “There is plenty of room for growth, but risk management must contend with high default rates, unacceptable fraud levels, and a credit model that is not designed to let households comfortably revolve consumer credit card debt. Interest rates are sky high to offset operational and fraud risk.”

This research report contains 31 pages and 15 exhibits.

Companies and other organizations mentioned in this research report include: ACI Worldwide, Advent International, Alibaba, Alipay, Amazon, Banco Credito, Banco de la Nacion Argentina, Banco de Bogata, Bancolombia, Banco CBSS, Banco de Chile, Banco de Mexico, Banco do Brasil, BBVA, Boleto Bancario, Bradesco, Caixa, Cielo, Citi, Citibanamex, CyberSource, Diners Club, Davivienda, Discover, Equifax, Experian, FICO, Fitch, HSBC, Itau, Mastercard, Mercado Libre, Mercado Pago,Nubank, OXXO, PagSeguro, Rappi, Santander, Scotiabank, SoftBank, Tencent, TransUnion, Visa, VisaNet, Vision Fund, and Walmart.

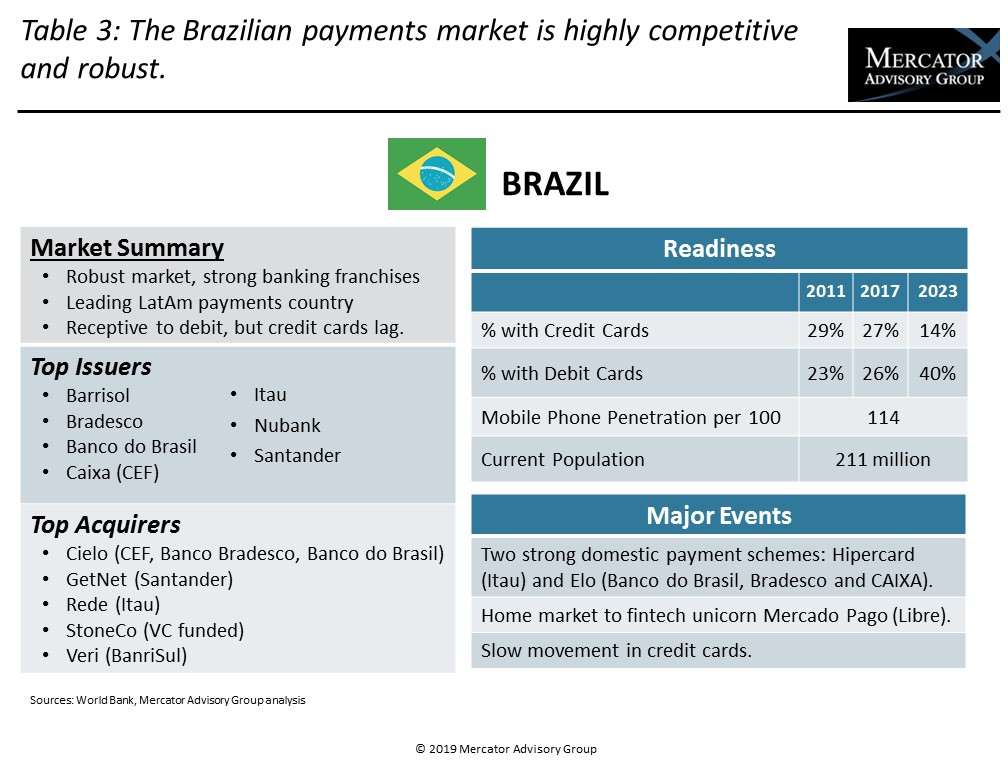

One of the exhibits included in this report:

- A review of network revenue, with a focus on Latin America and the Caribbean (LAC) region

- Forecasted market projections through 2023

- Credit card fraud rates in LAC markets

- A deep dive into payment card markets in Brazil, Mexico, Argentina, Colombia, Chile, and Peru

- E-commerce estimates through 2023

- Perspectives on top payment fintechs in LAC region

- Recommended strategies for credit card issuing banks

Book a Meeting with the Author

Related content

Credit Card Acquisitions: An Intro to Introductory Offers

The U.S. adult population grew by 10% from 2016 to 2025, but credit card acquisitions advanced at a rate almost five times faster. Cardholders are not just accumulating credit card...

DFAST: Tight Credit Card Risk Controls Ensure Bank Liquidity

Top financial institutions are prepared to navigate a severe economic shift, based on the results of the 2025 Dodd-Frank stress tests. Credit card losses continue to be the most si...

From Hype to Impact: How AI is Transforming Credit

Advances in artificial intelligence have generated a high level of excitement and marketing spending as financial organizations seek to rebrand their technologies with “AI” and dev...

Make informed decisions in a digital financial world