Overview

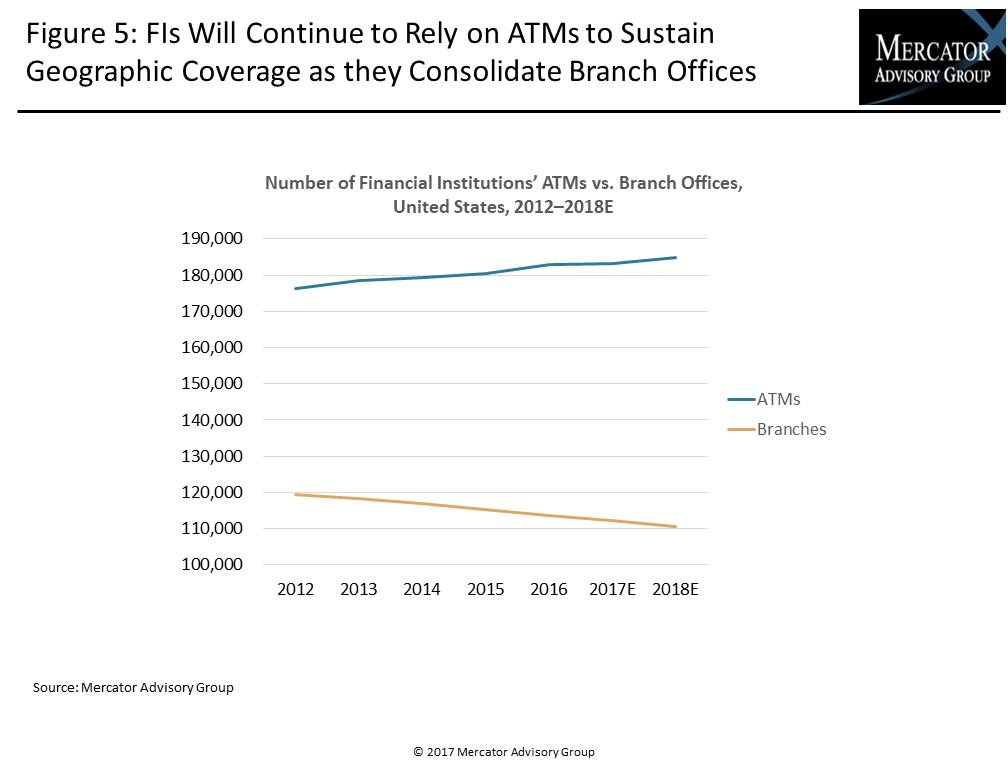

Mercator Advisory Group’s latest research report from the Customer Interaction Advisory Service, 2017 ATM Market Benchmark Report, presents benchmark statistics on the ATM market in the United States and globally. It also presents evidence for the changing role of the ATM as banks and credit unions continue consolidating their branch offices, broadening their ATM footprint, and turning to independent ATM deployers to manage and operate the devices. The report discusses enhanced capabilities that are making the ATM a central channel that will shape the way consumers will navigate an increasingly personalized banking experience in the years to come. ATMs remain essential for access to cash through mobile cash access pre-staging of transactions and for online banks, which have no branch infrastructure.

“Financial institutions are seeking to expand engagement with customers while reducing costs associated with physical points of presence. As they continue to consolidate branches, the ATM is being enabled to taking on more of the workload that previously required direct interactions with a teller or bank representative,” commented Joseph Walent, Associate Director of Mercator’s Customer Interaction Advisory Service, author of the report.

This research report contains 18 pages and 9 exhibits.

One of the exhibits included in this report:

Highlights of the research report include:

- ATM concentration in select countries, 2016

- Number of ATMs owned and operated by leading financial institutions in the U.S., 2014–2016

- Number of branches of leading financial institution ATM owner-operators in the U.S., 2014–2017E

- Leading independent ATM operators in the U.S.: FI/ISO/IAD Solution Providers, 2014–2017E

- Factors key in bank selection according to Mercator Advisory Group’s CustomerMonitor Survey Series banking channels survey

- The shift U.S. consumer preference as to how they access and where they cash

Book a Meeting with the Author

Related content

Payment Hubs Stand at a Crossroads

Payment hubs promised to simplify payments, but many never lived up to that vision. As real-time payments, open banking, and platform modernization reshape the landscape, banks are...

Stablecoins vs. Tokenized Deposits

Stablecoins and tokenized deposits are redefining how banks participate in digital money. Much of the current discussion centers on which of these instruments banks should emphasiz...

Real-Time Payments: Use Cases in Acquiring

The real time payments made possible through The Clearing House’s RTP and the Fed’s FedNow payment rails are making headlines, with promises of efficiency and lightning fast paymen...

Make informed decisions in a digital financial world