Credit Card Rewards Rule Affluent Consumers Payments

JAVELIN Examines Strategies for Affluent Customer LoyaltySan Francisco, CA, April 6, 2016: In today’s post recession environment of greater regulations and tighter profit margins, attracting and retaining affluent customers is more important than ever for payment providers. JAVELIN defines affluent as anyone who reports an annual household income of $100,000 or more, which is 22% of the U.S. adult population. Today, JAVELIN released, Affluent Consumer Respond to Credit Card Reward with More Than Card Loyalty, which examines affluent consumers’ payment and feature preferences, and strategies for banks and payment companies to earn—and keep—affluent customer loyalty.

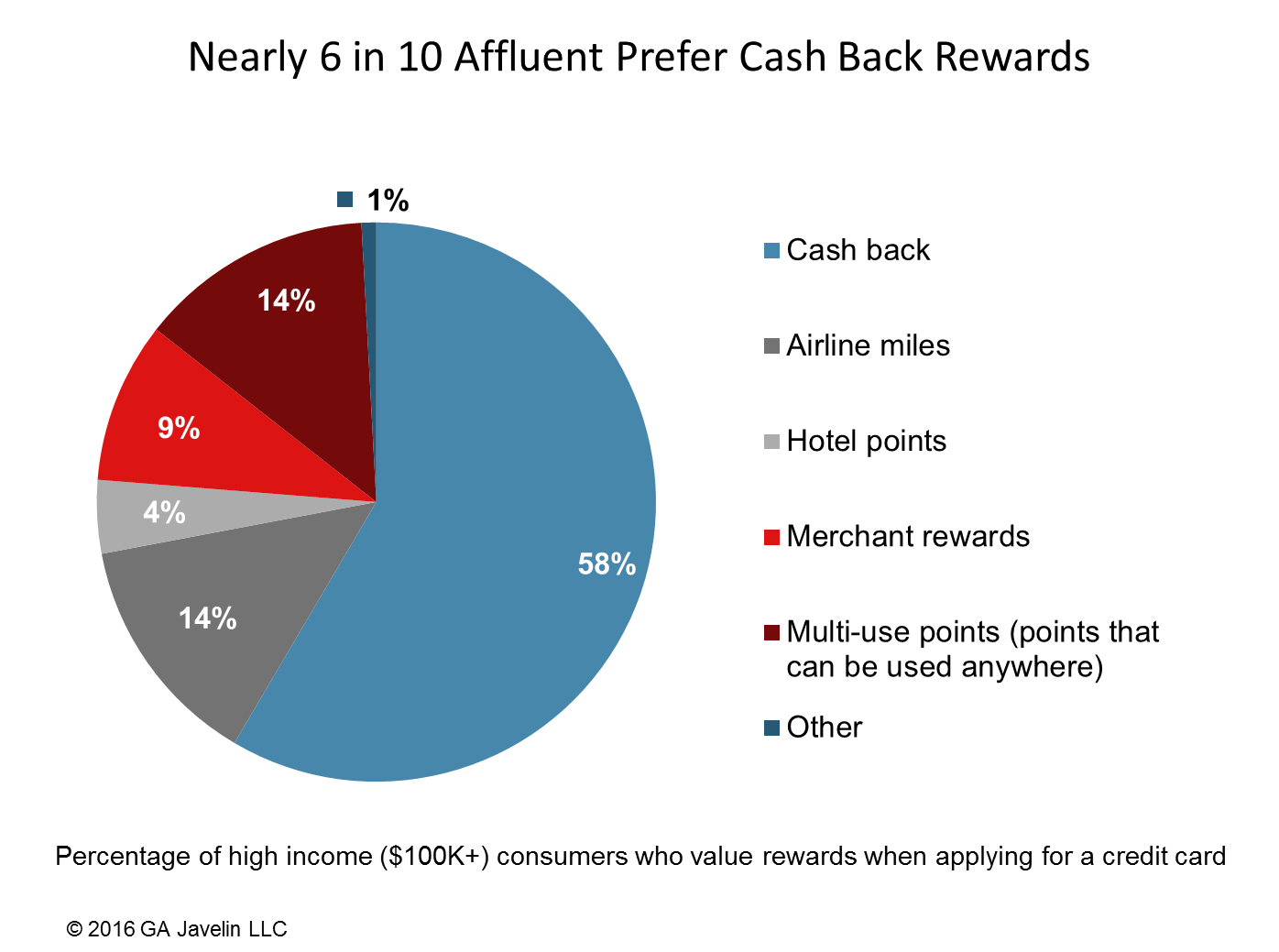

Selected major banks have reported that credit cards now make up more of their business profits compared to before the recession. Credit card companies that offer robust rewards are well situated to acquire affluent customers. Almost 6 in 10 (59%) affluent consumers indicate that the rewards are an important factor determining which credit card they apply for. While cash back may be the king of rewards for affluent consumers, co-branded loyalty points and miles programs resonate very well, as well as annual fee, sign-on rewards bonus, interest rate and EMV chip.

“Think beyond cash back when exploring reward options, as the affluent are drawn to more noncash options than nonaffluent", said Michael Moeser, Director of Payments, JAVELIN. "Payment providers need to design reward programs that target younger affluent customers in order to build their loyalty and reward them for product cross-sales.”

The report, Affluent Consumer Respond to Credit Card Reward with More Than Card Loyalty, results are based primarily on information gathered from multiple Javelin surveys conducted in 2015 from over 12,000 consumers.

Related JAVELIN Research

About JAVELIN

JAVELIN, a Greenwich Associates LLC company, provides strategic insights into customer transactions, increasing sustainable profits for financial institutions, government, payments companies, merchants and other technology providers. JAVELIN’s independent insights result from a uniquely rigorous three-dimensional research process that assesses customers, providers, and the transactions ecosystem.

Media Contact:

Nancy Ozawa

Marketing Communications

(925) 219-0116

marketing@javelinstrategy.com

www.javelinstrategy.com

Twitter: @JavelinStrategy