Consumers Crave Digital Account Opening Capabilities

Javelin Identifies Digital Account Opening Adoption Rates and Perceived Weaknesses

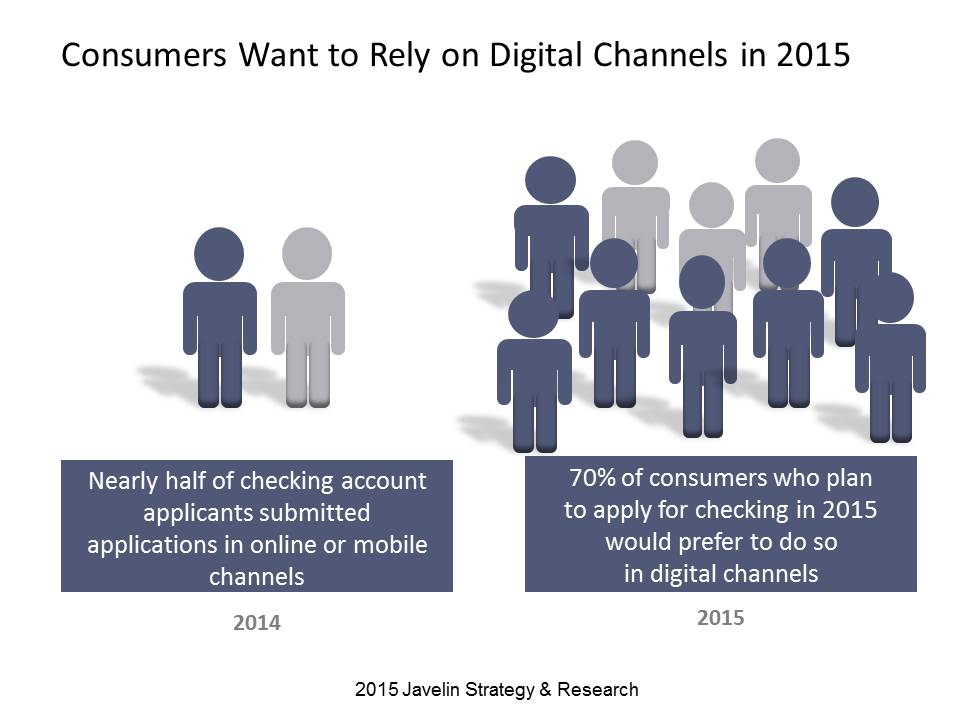

San Francisco, CA, March 5, 2015: Bankers who are intent on preparing for the day when digital channels will dominate account opening should rethink their timing. That day might already have arrived. The checking account – the foundational bank account that Americans have long established face-to-face at a branch – is at a tipping point with 70% of likely applicants saying they would prefer to submit a digital application in 2015. The far-reaching implications apply not only to the “branch of the future” but also to the branch-centric culture of banking itself. Today, Javelin Strategy & Research’s report, Digital Account Opening Reaches the Tipping Point, finds Americans are increasingly comfortable with digital channels to open various financial accounts. It also recommends strategies for financial institutions to optimize the omnichannel experience in order to maximize the number of completed and qualified applications.

In 2014, more Americans applied for credit cards and a variety of loan and investment accounts through online and mobile channels – with the volume of applications on smartphones and tablets jumping more than 60% for auto loans, mortgages, and credit cards. The upshot is that retail banking is facing a fundamental and irreversible shift. The branch-centric culture of banking will need to comingle with digital channels to deliver a consistent consumer omnichannel experience.

While digital account opening is winning for many, there are still several perceived weaknesses that financial institutions must address. Notably, for digital channels to gain usage, they must counter the perception that branches have the edge when it comes to protecting personal data (69% vs. 31%) and for obtaining answers to questions (60% vs. 40%).

“Financial institutions will win by ensuring that applicants feel the outcome was smooth and seamless even if even if they start the process in one channel and finish in another. Applicants should never have to start over from scratch,” said Mark Schwanhausser, Director of Omnichannel Financial Services at Javelin.

Javelin’s Digital Account Opening Reaches the Tipping Point assesses account opening channel preferences, account opening for various types of accounts including auto, credit card, loans and investment accounts. The report also explores features and marketing messages that sway an applicant to apply in digital versus in a branch. It is based on a survey of 3,100 American adults.

Related Javelin Research

About Javelin Strategy & Research

Javelin Strategy & Research, a Greenwich Associates LLC company, provides strategic insights into customer transactions, increasing sustainable profits for financial institutions, government, payments companies, merchants and other technology providers. Javelin’s independent insights result from a uniquely rigorous three-dimensional research process that assesses customers, providers, and the transactions ecosystem.

Media Contact

Nancy Ozawa

Marketing Communications

(925) 219-0116

marketing@javelinstrategy.com

www.javelinstrategy.com/research