Commoditization Looms For Small Business Banking--Bank Switching on the Horizon

JAVELIN Explores the Effect of Digital Banking on Leading Small Businesses to Switch Banks

San Francisco, CA, August 4, 2016: While most retail customers view their banking relationship as purely transactional, small business banking has remained a relationship-based business. As a result, commoditization has not reached small business banking in full force — at least not yet. But as the effects of technology and the rise of nonbank providers facilitate fragmentation of financial relationships, FIs will begin to see the same trend among small business customers who have propensity to switch banks. Today, JAVELIN released, Small Business Bank Switching: Optimizing Digital Banking to Counter Commoditization, which takes a close look at the factors that motivate small businesses to switch banks or shift accounts, and what banks can do to maximize the relationship value.

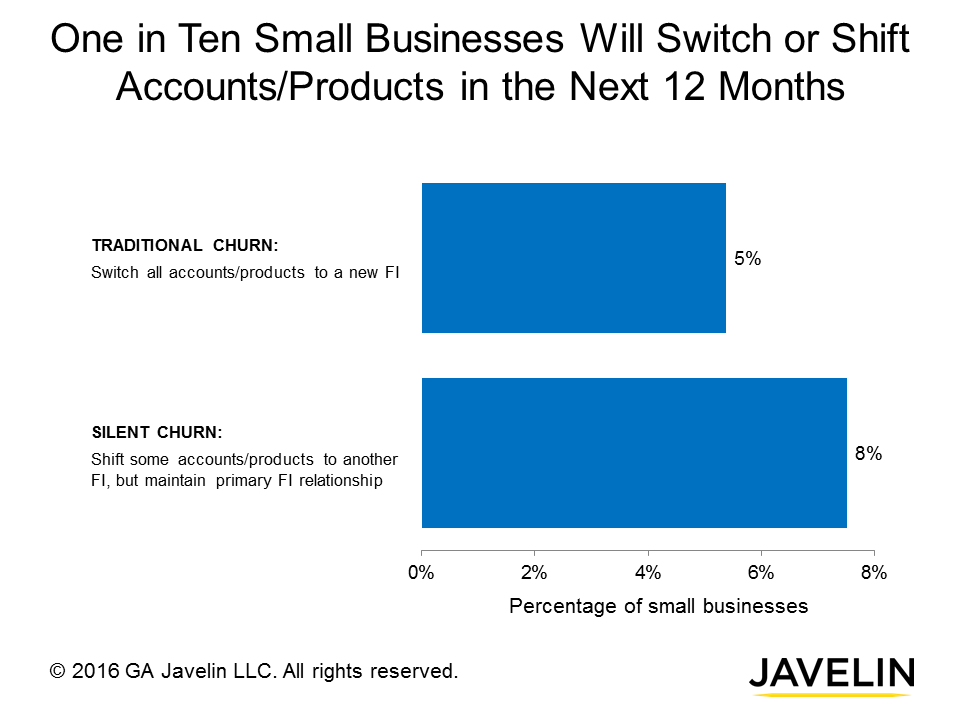

Today, 5% of small business owners and decision makers indicate “extreme” likelihood of switching to a new financial institution outright in the next 12 months, a figure that tracks accurately with actual churn rates. But 8% say they are likely to maintain their primary relationship but “shift” products or accounts to a secondary FI or third-party non-bank firm — a phenomenon JAVELIN has dubbed “silent churn. Small business decision makers considering switching banks cite fees, easier access to branches, and lower rates on credit cards as factors that could push them away, while online and mobile banking features rank highly as reasons business owners remain at their primary FI.

“As technology and increased choice allow small businesses to spread their financial accounts across various institutions, bankers need to be thinking about how to retain their customers by using digital banking to position themselves as a trusted financial partner. Banks have a solid opportunity, but the time to act is now,” said Jacob Jegher, Senior Vice President, Banking & Head of Strategy at JAVELIN.

The report, Small Business Bank Switching: Optimizing Digital Banking to Counter Commoditization, identifies push factors, pull factors and sticky factors that result in small business bank switching.

Related JAVELIN Research

- Bank Switching: Combating ‘Silent Churn’ to Maximize Primary FI Status

- ‘Build, Buy, or Partner’ and Beyond: How Alternative Lending is Reshaping Small Business Banking

- Small Business Demands Better Digital Banking Tools

About JAVELIN

JAVELIN, a Greenwich Associates LLC company, provides strategic insights into customer transactions, increasing sustainable profits for financial institutions, government, payments companies, merchants and other technology providers. Javelin’s independent insights result from a uniquely rigorous three-dimensional research process that assesses customers, providers, and the transactions ecosystem.

Media Contact

Nancy Ozawa

Marketing Communications

(925) 219-0116

marketing@javelinstrategy.com

www.javelinstrategy.com

Twitter: @JavelinStrategy