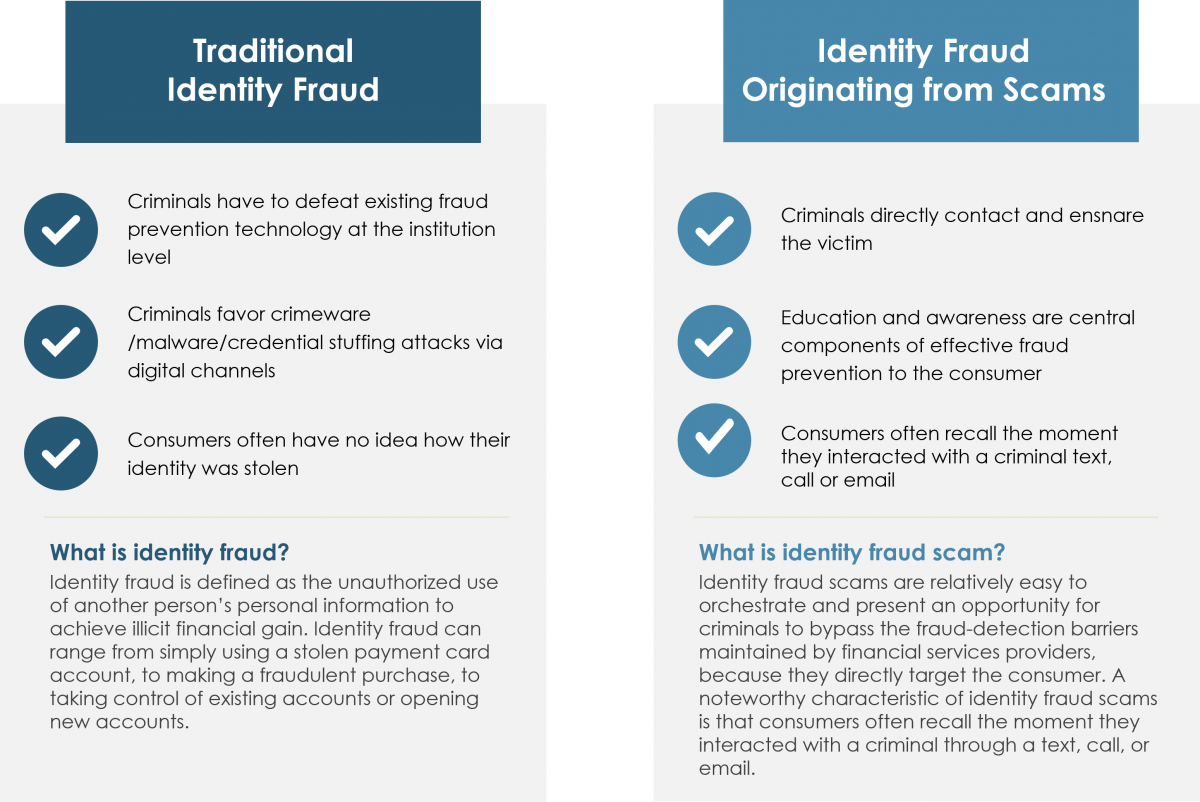

Identity fraud losses in 2020 reached a total of $56 billion (USD). This figure represents a combined total of $13 billion for traditional identity fraud (down 21% from 2019) and $43 billion for identity fraud scams. This inordinate growth can be attributed to criminals increasingly targeting consumers directly with scams to gain easy access to a treasure trove of personally identifiable information (PII) that enables them to take over a consumer’s identity. It is important to make a distinction between the two emerging types of identity fraud of attack vectors that criminals used in 2020 and will likely continue to use.

IDENTITY FRAUD TACTICS DIVERGE

KEY FINDINGS

The key findings of the annual report reveal a significant increase in identity fraud scams and loan fraud. Identity fraud has quickly evolved through unique societal changes related to innovation, the worldwide Covid-19 pandemic, and criminal tactics that focus on both corporate and consumer targets.

Javelin has been carefully evaluating the shifts in criminal behavior over the course of several years. Scams are easy to orchestrate and present a unique opportunity for criminals to bypass the fraud detection technology implemented by financial service providers to prevent criminals from gaining unauthorized access to consumer accounts. By targeting consumers directly, the criminals once again find their path of least resistance. Particularly during 2020, where everyone interacted almost exclusively via phone, text, email, and via social media platforms, vulnerable consumers were easy and abundant targets.

A noteworthy characteristic of identity fraud that originates from scams is the fact that consumers recall the moment they interacted with a criminal’s text, call, or email.

|

||||||

|

|

|

|

|

||

|

||||||

|

||||||

|

||||||

|

||||||

FREQUENTLY ASKED QUESTIONS

How is identity theft different than identity fraud?

Identity theft is defined by Javelin as unauthorized access of personal information. It can occur without identity fraud, such as through large-scale data breaches. Once the theft is coupled with illicit financial gain, then Javelin considers it identity fraud.

What steps can consumers take to protect themselves from current fraud threats?

Consumers can take active steps to prevent identity fraud from impacting their lives. Changing existing behaviors in how people use payments and make purchases will help in keeping their financial lives healthy. The following are recommendations for consumers to follow:

What are the most important things consumers can do to protect themselves from identity fraud?

There are a variety of digital tools that consumers can leverage to stay informed about the status of their accounts (like account alerts). The easiest method of detecting anomalous account activity is to simply review account activity on a daily or weekly basis. It is essential for consumers to report unusual transactions to their service providers as soon as possible to avoid additional losses or penalties in resolving suspected fraud activity.

Consumers are always encouraged to visit the Federal Trade Commission website if they wish to self-educate or file ID theft reports. To report incidents of suspected fraud or identity theft, visit the FTC online at http://www.ftc.gov/faq/consumer-protection/report-identity-theft

If consumers become victims, what should they do?

Consumers who think they are a victim of theft should take the following suggested actions:

|