Mobile P2P Projected to Skyrocket in the Next Five Years 180%

JAVELIN Examines Forefront of Change in P2P and Forecasts Mobile P2P Users

San Francisco, CA, October 8, 2015: The rise of mobile banking and social media, especially among Millennials, is giving consumers the ability to “talk and transact” in the same conversation. To the chagrin of many bankers, sending money person-to-person (P2P) has also gone from expensive to cheap or free. It is forcing many in the industry to rethink this revenue stream.

Today, JAVELIN released, Mobile P2P Payments in 2015: The Growth and Adoption of Mobile Money Transfers, which examines key customer segments, devices, and operating systems to target, analysis of key market players, and the overall forecast of the mobile P2P market.

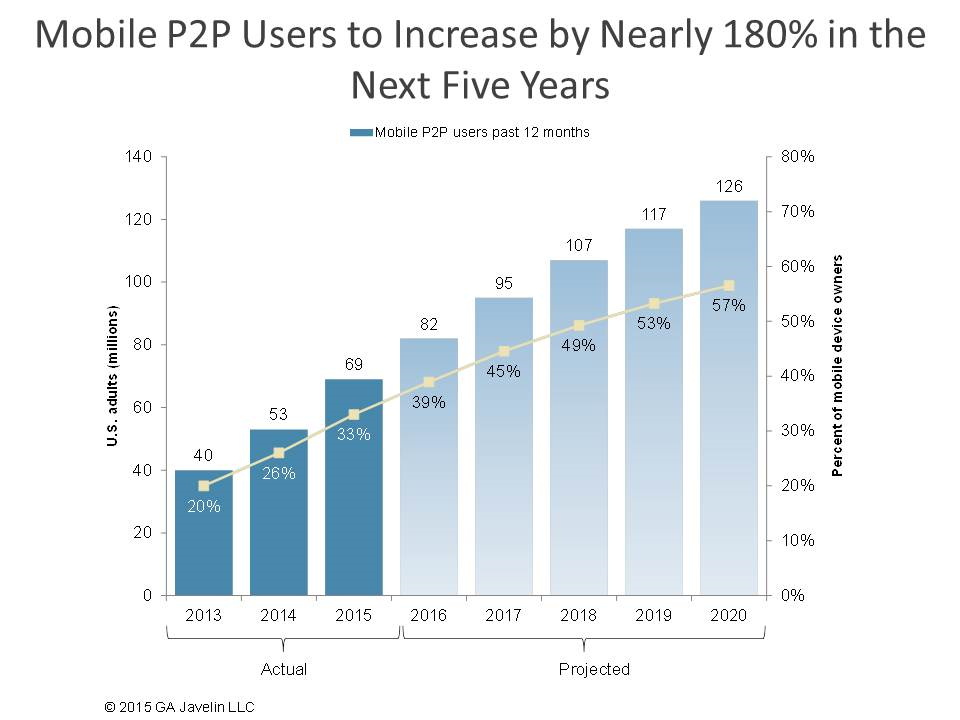

The number of mobile P2P users will grow rapidly, from 69 million in 2015 to 126 million by 2020. By 2019, it is expected that more than half of all mobile device owners will be using mobile P2P.

The influx of new mobile P2P users is attracting new non- bank competitors, who are focusing on facilitating commerce on their mobile and online platforms. These non-bank competitors include companies such as Facebook and Snapchat, who are keen to enhance the functionality of their social media apps to include everyday occurrences such as P2P money transfers.

“Traditional payment organizations and financial institutions now compete with nimble newcomers and need to maintain design, experience, speed, and security in order to stay competitive. The payment industry is now face-to-face with an extremely active and social customer base. Many existing and potential P2P vendors are contemplating what new features or services will resonate best with P2P users,” said Michael Moeser, Director of Payments, Retail and Small Business, at JAVELIN.

The report, Mobile P2P Payments in 2015: The Growth and Adoption of Mobile Money Transfers, includes survey of over 6,000 U.S. adults. The report includes analysis of 13 P2P players, including: clearXchange, Dwolla, Facebook, Fiserv Popmoney, Google Wallet, MasterCard Send, MoneyGram, PayPal, Snapchat, Square Cash, Venmo, Visa Direct and Western Union.

Related JAVELIN Research

- The Rise of the Mobile-First Consumer – and What it Means for Banking

- What Apple Watch Means for Banking and Payments

- Tablet Banking Forecasts 2014-2018: Design and Deployment Strategies for Mass Adoption

JAVELIN, a Greenwich Associates LLC company, (Twitter: @JavelinStrategy) provides strategic insights into customer transactions, increasing sustainable profits for financial institutions, government, payments companies, merchants and other technology providers. Javelin’s independent insights result from a uniquely rigorous three-dimensional research process that assesses customers, providers, and the transactions ecosystem.

Media Contact

Nancy Ozawa

Marketing Communications

(925) 219-0116

marketing@javelinstrategy.com

www.javelinstrategy.com/research