Working Capital Solutions Update: Efficiencies Will Take Time

- Date:June 25, 2015

- Author(s):

- Richard Hall

- Research Topic(s):

- Commercial & Enterprise

- PAID CONTENT

Overview

As the economic environment continues to recover, companies of all sizes continue to be faced with how to most effectively manage their buyer/supplier relationships. Management of working capital and payment terms is a daily set of activities that is gaining visibility from solution providers globally.

Mercator Advisory Group's research, Working Capital Solutions Update: Efficiencies Will Take Time, looks at the options available to companies and recent advances that have taken place to manage the complexities of the corporate payments system and potential impacts to the mix of providers to the segment.

"We have seen a significant increase in the number of solutions working to increase the level of visibility and automation in managing corporate payments,” comments Richard A. Hall, Director of Mercator Advisory Group’s Commercial and Enterprise Payments Advisory Service and author of the report. “Truly providing value for both buyers and suppliers remains challenging. Providers focused on managing working capital have a number of factors to address. In order to make a real impact, all parties are going to have to rethink how to approach things and move beyond traditional siloes of responsibility.”

The report is 20 pages long and contains 8 exhibits.

Members of Mercator Advisory Group's Commercial and Enterprise Payments Advisory Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Companies mentioned in this report include Ariba, Basware, Taulia, Traxpay.

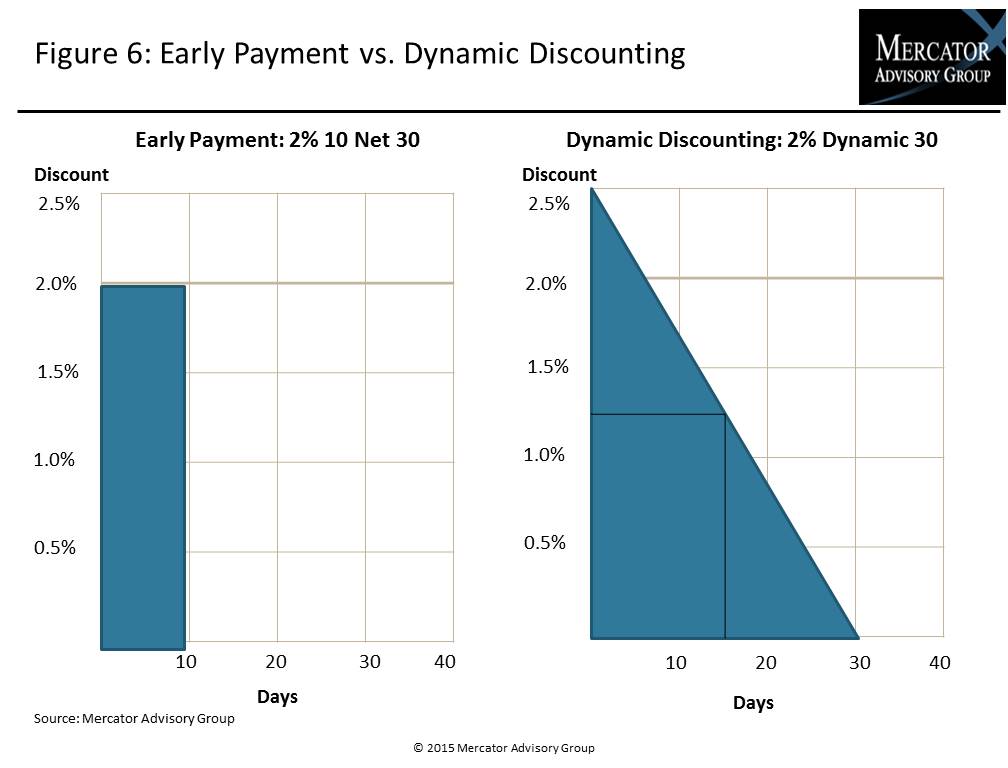

One of the exhibits included in this report:

Highlights of the report include:

- Evaluation of the current corporate payments environment

- Options for managing buyer/supplier payment relationships

- The importance of setting and managing performance metrics

- Potential impacts to existing participants in corporate payments

Learn More About This Report & Javelin

Related content

The Virtual Economy: Measuring Buyer Industry Receptiveness to Using Virtual Cards

Virtual cards are a fast-growing force in business-to-business payments, but adoption remains uneven across buyer industries. This report analyzes 147 U.S. industries using a compo...

AI in Commercial Payments: Do Payables Bots Dream of Dynamic Discounts?

AI’s transformative effects are becoming evident in how businesses source and buy things. The growing use of AI—predictive, generative, and agentic—across the source-to-settle valu...

Bots in the Back Office: Agentic AI and Commercial Payments

Agentic artificial intelligence stands to reshape commercial payments, from sourcing to settlement. Accordingly, banks, enterprise resource planning providers, and fintechs would b...

Make informed decisions in a digital financial world