Supplier Enablement of Cards in B2B E-Payments Requires Persistence, Data, and Technology

- Date:December 22, 2016

- Research Topic(s):

- Commercial & Enterprise

- PAID CONTENT

Overview

In a new research report, Supplier Enablement of Cards in B2B E-Payments Requires Persistence, Data and Technology, Mercator Advisory Group discusses supplier enablement, recommending fundamental approaches for success, suggesting tools to enhance suppliers’ recognition of the value proposition of B2B e-payments, and reviewing innovative business/technology trends that will have an impact on the industry.

"While the commercial card industry continues to benefit from the ongoing shift away from cash and checks and the increase in purchase volume, vast opportunities still exist for growth in cards as payables tools,” commented Steve Murphy, Director of Mercator Advisory Group’s Commercial and Enterprise Payments Advisory Service and author of the report. “There is substantial untapped potential, given the size of the market. The effort to drive further adoption of virtual cards among suppliers is one of the key activities of commercial card issuers and their corporate clients.”

The note is 24 pages long and contains 10 exhibits.

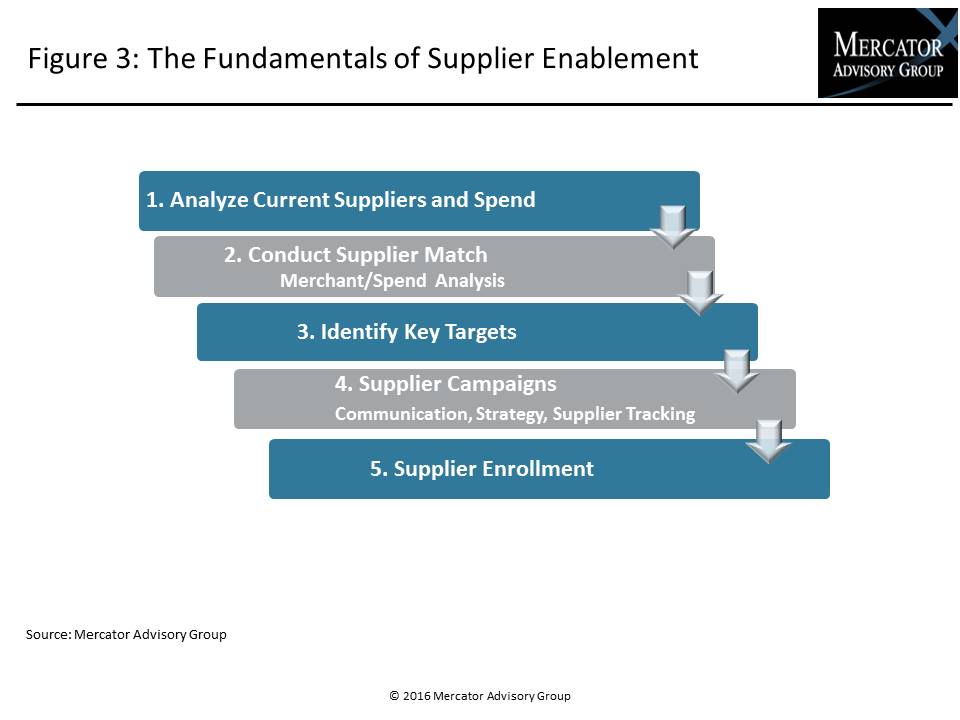

One of the exhibits included in this report:

- A step-by-step approach for fundamental success

- A discussion of the opportunities around driving revenue through scale versus interchange and rebates

- Methods to overcome the continuing greatest single hurdle, suppliers’ resistance to pricing

- A detailed review of the value proposition for suppliers

- A review of next-generation technology driving new business approaches that allow for flexible pricing and ease of card payments

Book a Meeting with the Author

Related content

The Virtual Economy: Identifying Supplier Industries Receptive to Virtual Cards

Although buyers increasingly favor virtual cards for their control, automation, and working capital benefits, many suppliers question whether acceptance delivers enough value to ju...

The Virtual Economy: Measuring Buyer Industry Receptiveness to Using Virtual Cards

Virtual cards are a fast-growing force in business-to-business payments, but adoption remains uneven across buyer industries. This report analyzes 147 U.S. industries using a compo...

AI in Commercial Payments: Do Payables Bots Dream of Dynamic Discounts?

AI’s transformative effects are becoming evident in how businesses source and buy things. The growing use of AI—predictive, generative, and agentic—across the source-to-settle valu...

Make informed decisions in a digital financial world