Overview

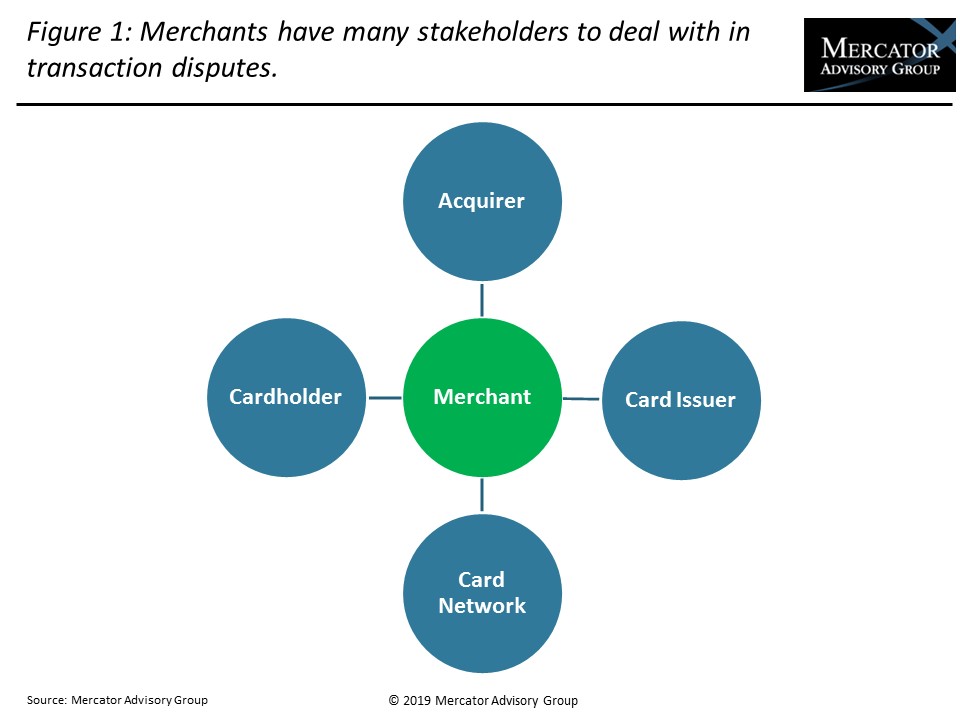

Merchants find themselves wrestling with the chargeback process, which is triggered when consumers dispute a purchase transaction, mostly on e-commerce sales. Increasingly, friendly fraud has also become a direct cause of merchant chargebacks. This report delves into chargeback reasons and implications as well as vendors of chargeback services that have emerged to provide solutions for merchants.

A new research report from Mercator Advisory Group, Merchant Chargebacks Are on the Rise Due to Friendly Fraud assesses the challenges and preventive solutions for this increasing problem that affects merchants of all sizes across vertical markets.

“Merchants are incurring a major pain point dealing with consumer-disputed sales transactions that can lead to chargebacks. This can mean merchants lose not only the sales revenue but also the merchandise and related overhead costs as well,” commented Raymond Pucci, Director, Merchant Services at Mercator Advisory Group, the author of this report.

This report is 14 pages long and has 2 exhibits.

Companies mentioned in this report: ACI Worldwide, American Express, Authorize.Net, BlueSnap, Braintree, CardinalCommerce, Chargeback, Chargebacks911, Chargeback Gurus, Chargehound, CyberSource, Discover, Ethoca, Federal Reserve Board, Lexis-Nexis, Mastercard, Midigator, PayPal, Stripe, Verifi, and Visa.

One of the exhibits included in this report:

Highlights of this research report include:

- Ease of the customer dispute process

- Why friendly fraud has been linked to chargebacks

- How crafty consumers game the dispute system

- Market data estimates of chargebacks and friendly fraud

- How merchants are combatting chargebacks

- Brief profiles of chargeback service companies

Book a Meeting with the Author

Related content

Unattended Checkout: Where Do We Go From Here?

Unattended checkout isn’t dying, not by a long shot, but it’s in a period of transition. Although consumers like it, merchants need it, and payment trends favor it, some major merc...

Real-Time Payments: Use Cases in Acquiring

The real time payments made possible through The Clearing House’s RTP and the Fed’s FedNow payment rails are making headlines, with promises of efficiency and lightning fast paymen...

In-House Payment Options for Merchants: Time for a New Look

The big household names in retail, in-store and online, have always offered customers the most choices of ways to pay, along with deferred terms like layaway or installment credit....

Make informed decisions in a digital financial world