Overview

IoT payments continue to drive increased revenue. Mercator research indicates IoT payments are growing up to 15% YoY and are part of strategic plans for Fortune 500 companies, some of whom indicate in annual reports that they expect IoT to disrupt existing markets.

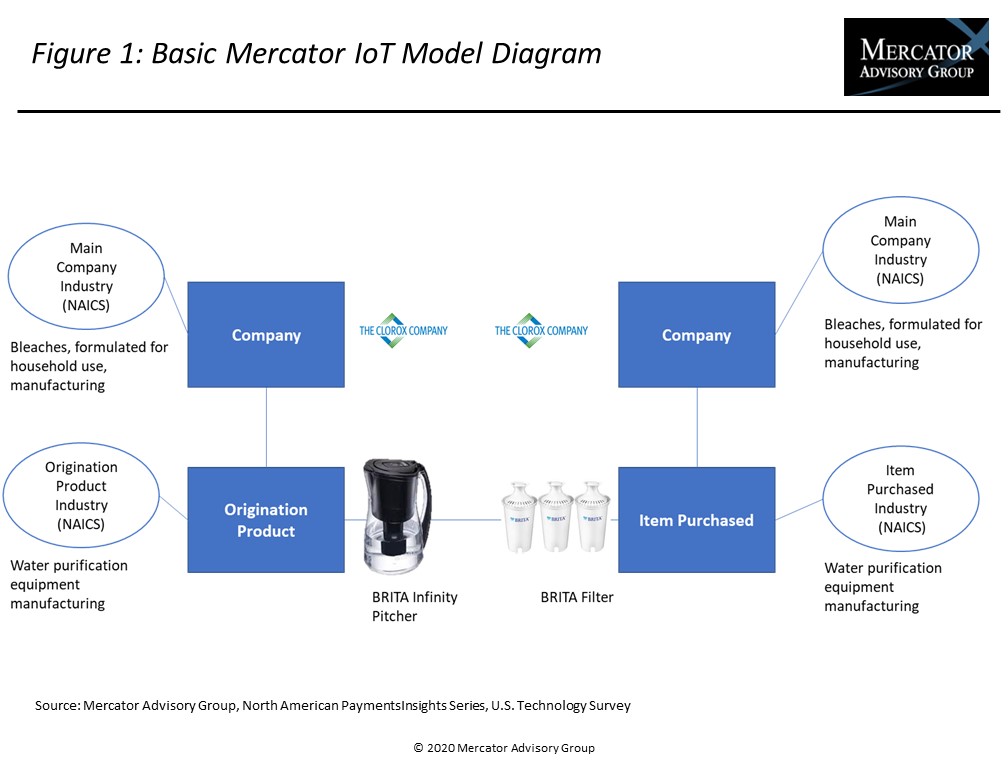

Mercator Advisory Group’s latest research report, IoT Payments: Taxonomy Driven Market Size and Company Rankings, delivers taxonomy driven market research that provides IoT payment market size by year, company, origination product, NAICS code, and as a percent of company revenue. The taxonomy utilized will enable Mercator to conduct industry specific competitive research projects and will dovetail that research with all other research performed using the NAICS database.

“Fortune 500 company innovation and growth strategy plans involve IoT payments. Companies see initiatives involving IoT payments as a way to differentiate and grow new business. Of the companies and IoT payments examined, IoT payments grew at an estimated 7% (2018-2019),” comments David Nelyubin, Research Analyst at Mercator Advisory Group and one of the authors of the report.

This research report has 19 pages and 10 exhibits.

Companies and other organizations mentioned in this report include: Amazon, Canon, Epson, Helen of Troy, HP, Philips, Proctor and Gamble, Progressive, Radio Systems Corporation, and The Clorox Company.

One of the exhibits included in this report:

Highlights of the report include:

- 2018-2019 US IoT payment market size by origination product (device) and company, year, replenishment item purchased and company, NAICS, and as a percent of company revenue.

- How IoT payments are perceived within companies that own products able to perform IoT payments.

- Existing closed loop and open loop IoT payment platforms and how these already complex technical and businesses environments will grow more complex as markets are created for both access to origination device data and for 3rd party sales of replenishment products.

Book a Meeting with the Author

Related content

2025 Emerging Biometric Authentication at the Point of Sale Scorecard

This inaugural Javelin Strategy & Research scorecard assesses the emerging market for biometric authentication at the point of sale and identifies three Pillars in this emerging te...

2026 Emerging Payments Trends

In emerging payments, hype comes first, often well in advance of the actual broad use of the payment tools and technologies. In 2026, after a year of press releases heralding the t...

Digital Money Comes to Payments, but the Crypto Has Disappeared

Digital money has come to payments, but the now isn’t the future that was once envisioned. “Cryptocurrency”—the word and the experience—is receding, and moving value through digita...

Make informed decisions in a digital financial world