Small Business Online Banking: Usage, Attitudes, and Preferences of Small Businesses

- Date:November 19, 2015

- Author(s):

- Michael Moeser

- Report Details: 20 pages, 7 graphics

- Research Topic(s):

- Small Business

- Digital Banking

- PAID CONTENT

Overview

As small and micro businesses continue to grow in the U.S., online banking platforms are becoming integral to how they conduct their business day after day. In this report, Javelin examines how frequently small and micro businesses log on to their online banking services; this indicates the importance of the service to their businesses. The report reviews the type of online banking platform used (retail, small business, or large commercial) and the businesses’ attitudes toward the service. Specifically, businesses are asked whether they would pay for the online banking platform and whether they would like to see their personal financial information integrated or viewable along with their business banking.

Key questions discussed in this report:

- How frequently do micro and small businesses log onto their online banking service?

- Do small businesses value their online banking platform from their primary bank?

- If required, would small businesses pay for the online banking service?

- Is there an opportunity to integrate personal finances from the business owner along with the small business finances for online banking?

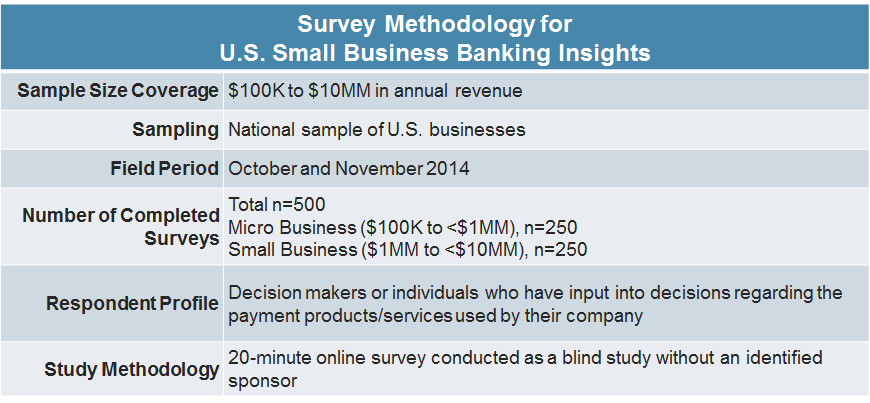

Methodology

Learn More About This Report & Javelin

Related content

How Accountants Shape Business Finances, And What Banks Can Do to Help

Running a small business starts out as a personal endeavor, but sooner or later complexity creeps in and an accountant is brought on board. Yet there’s no playbook for how to manag...

How to Turn Push Notifications into a Powerful Engagement Tool in Business Banking

Push notifications represent a missed opportunity in business banking. They have the potential to be one of the most direct and immediate ways for banks to engage with their custom...

Data Snapshot: The Nature of Work Is Changing

In these post-pandemic times, 38% of American professionals now engage in freelance work and must manage their complex financial lives with digital features and tools that are bett...

Make informed decisions in a digital financial world