Announcing Javelin’s 2016 Consumer Identity Safety Leaders

- Date:January 14, 2016

- Author(s):

- Test

- Kyle Marchini

- Research Topic(s):

- Fraud Management

- Fraud & Security

Javelin’s 2016 Consumer Identity Safety Leaders is the definitive view of the companies providing identity safety features to mitigate fraud risks for customers. Javelin evaluated the top 20 U.S. credit card issuers. We specifically examine the customer-facing security measures using Javelin’s Prevention, Detection, and Resolution® model.

2016 ‘BEST IN CLASS’ CONSUMER IDENTITY SAFETY LEADER

IS AWARDED TO:

USAA

2016 JAVELIN CONSUMER IDENTITY SAFETY LEADER

CREDIT CARD ISSUERS

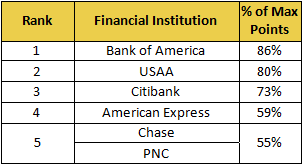

Prevention Category

The Prevention category evaluated features that protect consumers from fraud, including online and mobile authentication (e.g., one-time passwords, geolocation, and biometrics), customer education (e.g., general, mobile, social network safety), and customer-defined controls (e.g., restricting transactions over particular values).

2016 JAVELIN CONSUMER IDENTITY SAFETY LEADER

CREDIT CARD ISSUERS

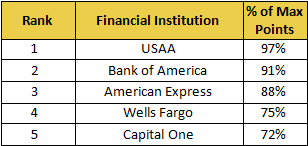

Detection Category

The Detection category scores issuers on features that help accountholders catch fraudulent activity, including transaction alerts (e.g., high-value, card-not-present, international), account information change alerts (e.g., new registered user, PIN, login password, address), and the available channels for alerts (e.g., phone, SMS, mobile app, email).

2016 JAVELIN CONSUMER IDENTITY SAFETY LEADER

CREDIT CARD ISSUERS

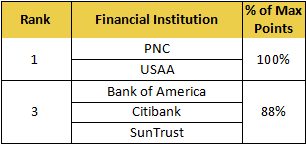

Resolution Category

The Resolution category examines features that help consumers recover their funds and accounts when fraud occurs. These include liability protection, accessibility of resolution assistance, expedited resolution (e.g., charge reversal in 24 hours, next-day card replacement), and “zero liability.”

Award Center: Consumer Identity Safety Leader

In the course of our ongoing market research, we find certain companies that rise to the top — recognizing these leaders for their exceptional quality of product or client experience, ability to meet customer demand, or overall excellence.

Javelin’s 2016 Consumer Identity Safety Leaders is the definitive view of the top 20 U.S. credit card issuers providing identity safety features to mitigate fraud risks for customers. We specifically examine the customer-facing security measures using Javelin’s Prevention, Detection, and Resolution® model.

About Javelin’s Credit Card Issuers’ Identity Safety Scorecard

Javelin’s 10th annual Credit Card Issuers’ Identity Safety Scorecard report provides insight into how the credit card industry’s customer‐facing security measures are affecting recent fraud trends and how issuers can improve their security infrastructure.

Methodology

Javelin evaluated the consumer‐facing protective features offered by 20 leading credit card issuers in the United States. Collection of data occurred October to November 2015. Issuers that offer only store-branded cards or a fewer number of network cards were not included. Preferred customer cards, secured cards, and affinity cards intended to accrue rewards toward a specific merchant or organization were not included in this report.

This year, Javelin revised its methodology by directly interviewing credit card issuers about their security measures according to the parameters of the scorecard, but without knowledge of weights assigned to either features or overall categories. Issuers that declined to participate in the self-evaluation were evaluated according to traditional mystery shopping methodology in November 2015. For these issuers, Javelin used a mystery‐shopper approach with customer service representatives in phone and web chats. On average, Javelin conducted 11 calls to each issuer. If researchers had any reason to doubt the information provided by a CSR, the call was terminated without adding to the average number of calls.

Only features that were implemented at the time of evaluation were considered for the scorecard. They include the top 18 MasterCard and Visa credit card issuers as ranked by the number of cards outstanding according to the Nilson Report, as well as two other issuers with significant cards outstanding: American Express and Discover.

Each year, the criteria in the Scorecard are modified to reflect evolution in the risk environment and related changes employed as security measures. Criteria were weighted differently in order to reflect the changes in fraudsters’ latest schemes and emphasize Javelin’s affirmation of the importance of particular features. The criteria were categorized according to Javelin’s Prevention, Detection, and Resolution® model. Prevention is the most heavily weighted category, accounting for 49 of 98 potential points, followed by Detection (32 points) and Resolution (17 points). Issuer scores were totaled for each category, revealing the highest-scoring issuers for each group. The categories were then aggregated for each issuer to reveal the top scorers overall.'

The top 20 credit card issuers evaluated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Learn More About This Report & Javelin

Related content

2024 Identity Fraud Study: Resolving the Shattered Identity Crisis

The Javelin Strategy & Research 2024 Identity Fraud Study provides a comprehensive analysis of fraud trends in the context of a changing technological and payments landscape. Its g...

Pig Butchering Scams: How Banks Can Stop the Slaughter

Pig butchering is a devastating, multilayered, drawn-out investment scam that leaves victims with nothing. By implementing robust customer education, employing effective fraud dete...

2024 Authentication and Identity-Proofing Vendor Solutions Scorecard

Identity-proofing, a fundamental need of financial services companies, is a space in considerable flux. Fintech companies that cut their teeth as e-commerce payments platforms are ...

Make informed decisions in a digital financial world